Xinhua News Agency, Beijing, June 20th Assumption of maritime cooperation in the construction of "Belt and Road"

In 2013, the Supreme Leader of president, China successively put forward major initiatives to jointly build the Silk Road Economic Belt and the 21st Century Maritime Silk Road. In 2015, the China Municipal Government issued "Vision and Action for Promoting the Joint Construction of the Silk Road Economic Belt and the 21st Century Maritime Silk Road", which put forward that policy communication, facilities connectivity, smooth trade, capital financing and people’s hearts should be the main contents, adhere to the principles of mutual consultation, joint construction and sharing, and actively promote the construction of the "Belt and Road", which has received extensive attention and positive response from the international community.

In order to further strengthen strategic docking and joint action with countries along the route, promote the establishment of an all-round, multi-level and wide-ranging blue partnership, protect and sustainably utilize the oceans and marine resources, realize the harmony and common development of the people and the sea, jointly enhance the well-being of the oceans, and jointly build and prosper the Maritime Silk Road in the 21st century, the National Development and Reform Commission and the State Oceanic Administration have specially formulated and issued the "Assumption of Maritime Cooperation on the Belt and Road".

I. Background of the Times

The ocean is the largest ecosystem on the earth, a common space and precious wealth for human survival and sustainable development. With the further development of economic globalization and regional economic integration, the cooperation in market, technology and information with the ocean as the carrier and link has become increasingly close, and the development of blue economy has gradually become an international consensus, and an era of paying more attention to and relying on maritime cooperation and development has arrived. "Walking alone is fast, and many people travel far". Strengthening maritime cooperation conforms to the world development trend and the general trend of open cooperation. It is an inevitable choice to promote closer economic ties, deeper mutually beneficial cooperation and broader development space for all countries in the world. It is also an important way for all countries in the world to jointly meet the crisis challenges and promote regional peace and stability.

Adhering to the Silk Road spirit of peaceful cooperation, openness, tolerance, mutual learning and mutual benefit, China Government is committed to promoting the implementation of the 2030 Agenda for Sustainable Development formulated by the United Nations in the marine field, and is willing to carry out all-round and multi-field maritime cooperation with countries along the Maritime Silk Road in the 21st century, jointly create an open and inclusive cooperation platform, establish an active and pragmatic blue partnership, and cast a "blue engine" for sustainable development.

Second, the principle of cooperation

Seek common ground while reserving differences and build consensus. Maintain the international maritime order, respect the diverse marine development concepts of countries along the route, take care of each other’s concerns, bridge cognitive differences, seek common ground while reserving differences, conduct extensive consultations and gradually reach a consensus on cooperation.

Open cooperation and inclusive development. Further open the market, improve the investment environment, eliminate trade barriers and promote trade and investment facilitation. Enhance political mutual trust, strengthen dialogue among different civilizations, and advocate inclusive development and harmonious symbiosis.

Market operation, multi-party participation. Follow the market rules and international rules, and give full play to the main role of enterprises. Support the establishment of multi-stakeholder partnerships and promote the extensive participation of governments, international organizations, civil society, business and industry in maritime cooperation.

Discuss and build together, and share benefits. Respect the development wishes of countries along the route, give consideration to the interests of all parties, give full play to the comparative advantages of all parties, seek common cooperation, jointly build and share achievements, promote the poverty eradication of developing countries, and promote the formation of a community of interests for maritime cooperation.

Third, the idea of cooperation

Take the ocean as a link to enhance common well-being and develop common interests, take sharing blue space and developing blue economy as the main line, strengthen strategic docking with countries along the 21st Century Maritime Silk Road, promote pragmatic cooperation in all fields, jointly build a smooth, safe and efficient maritime passage, jointly promote the establishment of a maritime cooperation platform, jointly develop a blue partnership, and move in the opposite direction along the road of harmonious development of green development, maritime prosperity, safety and security, intellectual innovation and cooperative governance, so as to benefit the people of all countries along the route.

According to the key direction of the Maritime Silk Road in the 21st century, the "Belt and Road" maritime cooperation is supported by China’s coastal economic belt, closely cooperates with countries along the route, connects the China-Indo-China Peninsula economic corridor, enters the Indian Ocean westward through the South China Sea, connects China-Pakistan, Bangladesh, China, India and Myanmar economic corridors, and jointly builds the China-Indian Ocean-Africa-Mediterranean blue economic corridor; Enter the Pacific Ocean southward through the South China Sea to jointly build a blue economic channel of China-Oceania-South Pacific; Actively promote the joint construction of a blue economic channel connecting Europe through the Arctic Ocean.

Fourth, the focus of cooperation

Focusing on building a mutually beneficial and win-win blue partnership, we will innovate cooperation modes, build cooperation platforms, jointly formulate several action plans, implement a number of exemplary and driving cooperation projects, take the road of green development, create a road of prosperity by the sea, build a road of safety and security, build a road of wisdom and innovation, and seek a road of cooperative governance.

(1) Take the road of green development together.

Maintaining marine health is the most inclusive welfare of people’s livelihood, which is beneficial to the present and the future. The Government of China proposes that countries along the route jointly launch marine ecological environmental protection actions to provide more high-quality marine ecological services and safeguard global marine ecological security.

Protect the health and biodiversity of marine ecosystems. Strengthen pragmatic cooperation in marine ecological protection and restoration, marine endangered species protection and other fields, promote the establishment of long-term cooperation mechanisms, and jointly build cross-border marine ecological corridors. Jointly carry out monitoring, health assessment, protection and restoration of typical marine ecosystems such as mangroves, seagrass beds and coral reefs, protect island ecosystems and coastal wetlands, and hold the Binhai wetlands international Forum.

Promote regional marine environmental protection. Strengthen cooperation in marine environmental pollution, marine garbage, marine acidification, red tide monitoring, pollution emergency and other fields, promote the establishment of marine pollution prevention and emergency cooperation mechanisms, jointly carry out marine environmental assessment, and jointly publish marine environmental status reports. Establish China-ASEAN cooperation mechanism for marine environmental protection. Promote cooperation in marine environmental protection under the framework of China-ASEAN environmental cooperation strategy and action plan. It is proposed that countries along the route jointly launch and implement the Green Silk Road Messenger Program to improve the marine environmental pollution prevention and control capabilities of countries along the route.

Strengthen cooperation on climate change in the marine field. Promote the demonstration of circular low-carbon development and application in the marine field. The Government of China supports the small island countries along the route to cope with global climate change, and is willing to provide technical assistance in dealing with marine disasters, sea level rise, coastal erosion and degradation of marine ecosystems, and support the countries along the route to conduct surveys and assessments on the island and coastal zone conditions.

Strengthen international cooperation in blue carbon. The Government of China initiated the Blue Carbon Plan of the 21st Century Maritime Silk Road, jointly carried out the monitoring, standards and carbon sink research of the blue carbon ecosystem in the ocean and coastal zone with countries along the route, jointly issued the Blue Carbon Report of the 21st Century Maritime Silk Road, and promoted the establishment of an international blue carbon forum and cooperation mechanism.

(B) to create a prosperous road by the sea

Promoting development and eradicating poverty is the common aspiration of people of all countries along the route. Give full play to the comparative advantages of various countries, scientifically develop and utilize marine resources, realize interconnection, promote the development of blue economy and share a better life.

Strengthen cooperation in the development and utilization of marine resources. Cooperate with countries along the route to carry out resource investigation, establish a resource list and resource pool, assist countries along the route to formulate plans for the development and utilization of marine resources, and provide necessary technical assistance. Guide enterprises to participate in marine resources development projects in an orderly manner. Actively participate in the investigation and evaluation of marine resources carried out by international organizations involved in the sea.

Improve the level of cooperation in marine industry. Build marine industrial parks and economic and trade cooperation zones with countries along the route, and guide China’s sea-related enterprises to participate in the park construction. Implement a number of blue economic cooperation demonstration projects to support developing countries along the route to develop mariculture, improve living standards and alleviate poverty. Work with countries along the route to plan and develop marine tourism routes, create quality marine tourism products, and establish a tourism information exchange and sharing mechanism.

Promote maritime interconnection. Strengthen international maritime cooperation, improve the shipping service network between countries along the route, and jointly build international and regional shipping centers. Strengthen port cooperation along the route by concluding sister port or sister port agreements and forming port alliances, and support China enterprises to participate in the construction and operation of ports along the route in various ways. Promote joint planning and construction of submarine optical cable projects and improve the level of international communication interconnection.

Improve the level of maritime facilitation. Strengthen communication and coordination with relevant countries, and cooperate closely around standardizing the international transportation market and improving the level of transportation facilitation. Accelerate cooperation with relevant countries in the areas of mutual recognition of port supervision, mutual assistance in law enforcement and information exchange.

Promote the construction of information infrastructure connectivity. We will build an information transmission, processing, management and application system, an information standard and specification system and an information security system covering the 21st Century Maritime Silk Road, so as to provide a public platform for network interconnection and information resource sharing.

Actively participate in the development and utilization of the Arctic. The Government of China is willing to jointly carry out a comprehensive scientific investigation of the Arctic waterway, establish an Arctic shore-based observatory, study the climate and environmental changes in the Arctic and their impacts, and provide waterway forecasting services. Support countries around the Arctic Ocean to improve the transportation conditions of the Arctic waterway, and encourage China enterprises to participate in the commercial utilization of the Arctic waterway. We are willing to cooperate with relevant countries in the Arctic to carry out resource potential assessment in the Arctic region, encourage China enterprises to participate in the sustainable development of Arctic resources in an orderly manner, and strengthen clean energy cooperation with Arctic countries. Actively participate in the activities of relevant international organizations in the Arctic.

(3) Building a road of safety and security together

Maintaining maritime safety is an important guarantee for developing blue economy. Advocate the concept of mutual benefit, cooperation and win-win maritime security, strengthen cooperation in marine public services, maritime management, maritime search and rescue, marine disaster prevention and mitigation, maritime law enforcement and other fields, improve the ability to prevent and resist risks, and jointly safeguard maritime security.

Strengthen cooperation in marine public services. The Government of China initiated the plan to build and share marine public services along the 21st Century Maritime Silk Road, advocated the countries along the route to build and share the marine observation and monitoring network and the comprehensive survey and measurement results of the marine environment, and increased technical and equipment assistance to the marine observation and monitoring infrastructure of developing countries along the route. The government of China is willing to strengthen international cooperation in the application of Beidou satellite navigation and remote sensing satellite system in the marine field, and provide satellite positioning and remote sensing information applications and services for countries along the route.

Carry out cooperation in maritime navigation safety. The Government of China is willing to undertake corresponding international obligations, participate in bilateral and multilateral maritime navigation safety and crisis management and control mechanisms, jointly carry out activities in non-traditional security fields such as combating maritime crimes, and jointly safeguard maritime navigation safety.

Conduct joint maritime search and rescue. Under the framework of international conventions, the government of China is willing to undertake corresponding international obligations, strengthen information exchange and joint search and rescue with countries along the route, establish mutual visits of maritime search and rescue forces, share search and rescue information, exchange training and joint drills for search and rescue personnel, and enhance the common emergency and action capability of maritime emergencies such as disaster disposal and tourism safety.

Work together to improve marine disaster prevention and mitigation capabilities. It is proposed to jointly build a marine disaster early warning system in key sea areas such as the South China Sea, the Arabian Sea and the Gulf of Aden, and jointly develop marine disaster early warning products to provide services for maritime transportation, maritime escort and disaster prevention. Support the operational operation of the South China Sea Tsunami Warning Center and provide tsunami warning services to neighboring countries. We will promote the establishment of a cooperative mechanism for marine disaster prevention and mitigation with countries along the route, set up training bases, carry out cooperative research and application demonstration on marine disaster risk prevention and catastrophe response, and provide technical assistance to countries along the route.

Promote maritime law enforcement cooperation. Strengthen dialogue with countries along the route, control differences, promote maritime law enforcement cooperation under the bilateral and multilateral framework, establish and improve cooperation mechanisms such as maritime joint law enforcement, fishery law enforcement, maritime anti-terrorism and riot prevention, promote the construction of maritime law enforcement liaison network, and jointly formulate emergency plans for emergencies. Strengthen exchanges and cooperation with maritime law enforcement departments of countries along the route to provide necessary assistance for maritime law enforcement training.

(D) to build a road of wisdom and innovation

Innovation is the source power to lead the sustainable development of the ocean. Deepen cooperation in marine scientific research, education and training, cultural exchanges and other fields, enhance marine awareness, promote the application of scientific and technological achievements, and lay a public opinion foundation for deepening maritime cooperation.

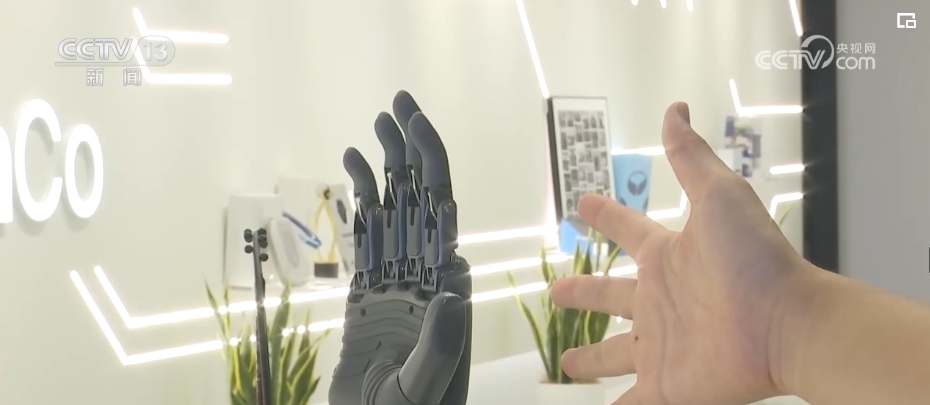

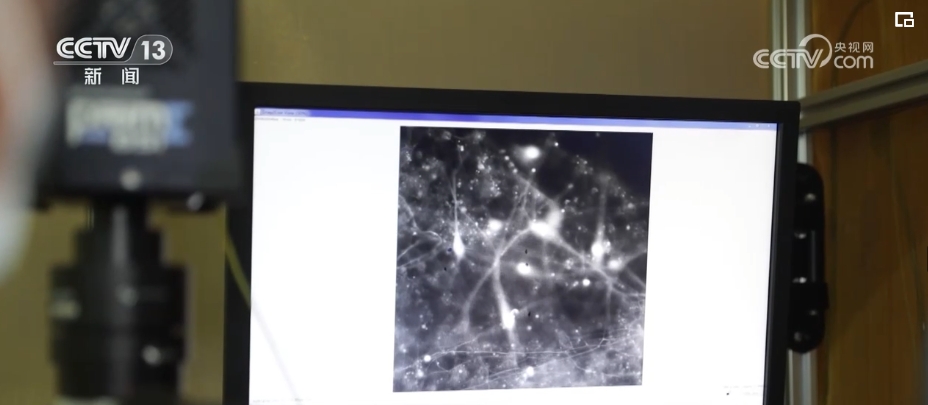

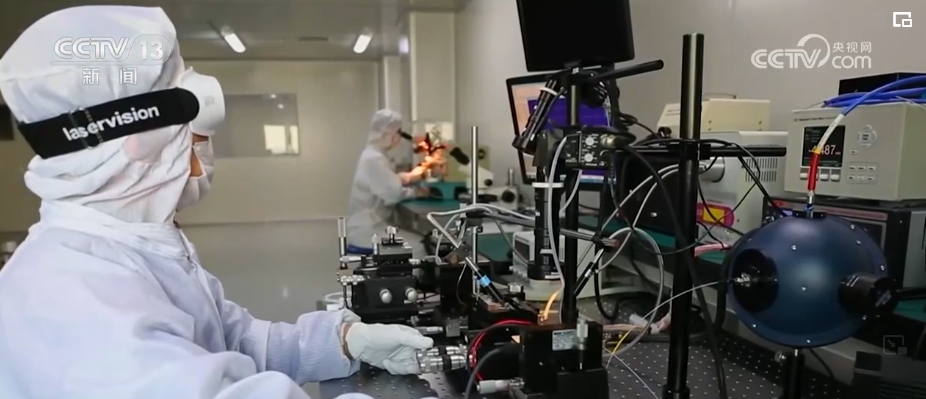

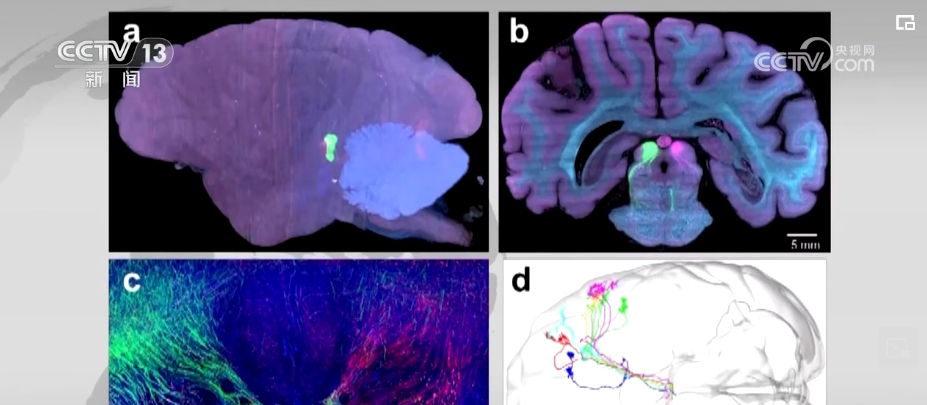

Deepen marine scientific research and technical cooperation. Co-sponsor the marine science and technology partnership program with countries along the route, and jointly carry out major projects such as scientific investigation and research on key sea areas and passages of the Maritime Silk Road in the 21st century, observation and research on monsoon-ocean interaction, anomaly prediction and impact assessment. Deepen cooperation in the fields of marine survey, observation equipment, renewable energy, seawater desalination, marine biopharmaceuticals, marine food technology, offshore unmanned aerial vehicles, unmanned ships, etc., strengthen cooperation in docking and technology transfer of marine technical standards systems, and support scientific research institutions and enterprises to jointly build overseas technology demonstration and promotion bases.

Build a platform for cooperation in marine science and technology. We will build a platform for the interconnection and sharing of marine research infrastructure and scientific and technological resources with countries along the route, and cooperate in the construction of marine science and technology cooperation parks. We will promote the construction of APEC Marine Sustainable Development Center, East Asia Marine Cooperation Platform, China-ASEAN Marine Cooperation Center, China-ASEAN Ocean College, China-East Asia Sea Environmental Management Partnership Program Coastal Zone Sustainable Management Cooperation Center, China-Malaysia Joint Research Center, China-Indonesia Ocean and Climate Center, China-Thailand Joint Laboratory of Climate and Marine Ecosystem, China-Pakistan Joint Marine Research Center, and China-Israel Joint Research Center for Seawater Desalination, so as to jointly improve the innovation capability of marine science and technology.

Build and share a smart ocean application platform. We will jointly promote the sharing of marine data and information products among countries, establish cooperation mechanisms and networks among marine data centers, jointly carry out reanalysis research and application of marine data, and build a marine and marine climate data center on the Maritime Silk Road in the 21st century. Joint research and development of marine big data and cloud platform technology, and construction of marine public information sharing service platform for economic and social development.

Carry out marine education and cultural exchanges. We will continue to implement the China Government’s Ocean Scholarship Program, and expand the scale of study and training for personnel from countries along the route. Promote the implementation of marine knowledge and cultural exchange and integration plan, support China coastal cities to become sister cities with cities along the route, and strengthen exchanges and cooperation with marine public welfare organizations and popular science institutions along the route. Carry forward Mazu marine culture, promote the construction of Mazu marine cultural center in the world, promote exchanges and cooperation in marine cultural heritage protection, underwater archaeology and excavation, hold marine culture year and marine art festival with countries along the route, and inherit and carry forward the friendly and cooperative spirit of the 21st century Maritime Silk Road.

Jointly promote the spread of sea-related culture. Strengthen media cooperation, carry out cross-border interview activities, and build a circle of media friends on the 21st Century Maritime Silk Road. Innovate the mode of communication, and jointly create a multi-national civilization and multi-lingual media form. Work together to develop literary and artistic creations related to the sea, and jointly produce literary and artistic works that show the customs and friendly exchanges of countries along the route, and consolidate the foundation of public opinion.

(E) the road of collusion and cooperative governance

Establishing a close blue partnership is an effective channel to promote maritime cooperation. Strengthen strategic docking and dialogue and consultation, deepen cooperation consensus, enhance political mutual trust, establish a bilateral and multilateral cooperation mechanism, and jointly participate in ocean governance to provide institutional guarantee for deepening maritime cooperation.

Establish a high-level dialogue mechanism in the ocean. Establish a multi-level and multi-channel communication, consultation and dialogue mechanism with the coastal areas, promote the signing of intergovernmental and inter-departmental marine cooperation documents, jointly formulate cooperation plans, implementation plans and road maps, and jointly promote the implementation of major projects. We will promote the establishment of a high-level dialogue mechanism among countries along the Maritime Silk Road in the 21st century, jointly promote the implementation of the action plan and jointly address major marine issues. China-small island countries maritime ministers round table and China-Southern European countries maritime cooperation forum will be well organized.

Establish a blue economic cooperation mechanism. Establish a global blue economic partnership forum, promote new concepts and practices of blue economy, and promote industrial docking and capacity cooperation. Jointly formulate and promote the international standard of statistical classification of blue economy, establish a data sharing platform, carry out the blue economy assessment of countries along the Maritime Silk Road in the 21st century, compile and publish the blue economy development report, and share successful experiences. Create marine financial public products and support the development of blue economy.

Carry out research and application of ocean planning. Jointly promote the formulation of cross-border marine spatial planning with the goal of promoting blue growth, implement common principles and standards, share best practices and evaluation methods, and promote the establishment of an international forum on marine spatial planning including relevant stakeholders. The Government of China is willing to provide training and technical assistance for countries along the route in marine development planning, and help them to formulate marine development planning.

Strengthen cooperation with multilateral mechanisms. Support the establishment of marine cooperation mechanisms and institutional rules under multilateral cooperation mechanisms such as APEC, East Asian Cooperation Leaders’ Meeting, China-Africa Cooperation Forum and China-Pacific Island Countries Economic Development Cooperation Forum. Support the role of the United Nations Intergovernmental Oceanographic Commission, the East Asian Sea Environmental Partnership, the Indian Ocean Rim Alliance and the International Ocean Academy to jointly organize and promote major plans and projects.

Strengthen exchanges and cooperation in think tanks. We will promote dialogue and exchanges between think tanks of countries along the route, cooperate in research on strategic and policy docking, and jointly launch major initiatives to provide intellectual support for building the 21st Century Maritime Silk Road. The Government of China supports domestic think tanks to establish strategic partnerships with relevant institutions of countries along the route and international marine organizations, and promotes the establishment of the 21st Century Maritime Silk Road think tank alliance, creating a cooperation platform and collaboration network.

Strengthen cooperation among non-governmental organizations. Encourage non-governmental organizations in countries along the route to carry out marine public service, academic discussions, cultural exchanges, scientific and technological cooperation, knowledge dissemination and other activities, and promote the mutual promotion of cooperation between non-governmental organizations and intergovernmental cooperation, and jointly participate in marine governance.

V. Positive actions

The China Municipal Government attaches great importance to maritime cooperation with relevant countries, strengthens strategic communication, builds a cooperation platform, and carries out a series of cooperation projects, and the overall progress is smooth.

Top leaders lead the push. Under the witness of China and the leaders of relevant countries, it has signed intergovernmental cooperation agreements, memorandums of cooperation and joint statements in the marine field with Thailand, Malaysia, Cambodia, India, Pakistan, Maldives, South Africa and other countries, carried out strategic docking with many countries along the route, and established extensive marine cooperation partnerships.

Build a cooperation platform. Cooperation mechanisms such as Blue Economy Forum, Marine Environmental Protection Seminar, Maritime Consultation, Maritime Cooperation Forum, China-ASEAN Maritime Cooperation Center, and East Asia Maritime Cooperation Platform have been established under the mechanisms of APEC, East Asia Cooperation Leaders’ Meeting and China-ASEAN Cooperation Framework. The 21st Century Maritime Silk Road Expo, 21st Century Maritime Silk Road International Art Festival and World Mazu Marine Culture Forum have been held successively, which have played an important role in enhancing understanding, building consensus and deepening maritime cooperation.

Increase capital investment. The China government has made overall plans for domestic resources, established the China-ASEAN Maritime Cooperation Fund and the China-Indonesia Maritime Cooperation Fund, and implemented the Framework Plan for International Cooperation in the South China Sea and Its Surrounding Seas. The Asian Infrastructure Investment Bank and Silk Road Fund provided financial support for major maritime cooperation projects.

Promote internal and external docking. The China Municipal Government encourages economic zones and coastal port cities such as the Bohai Rim, the Yangtze River Delta, the west coast of the Taiwan Strait and the Pearl River Delta to give full play to their local characteristics, increase opening up and deepen pragmatic cooperation with countries along the route. Support the construction of Fujian 21st Century Maritime Silk Road core area, Zhejiang Marine Economic Development Demonstration Zone, Fujian Strait Blue Economic Experimental Zone and Zhoushan Islands Marine New Area, and increase the development and opening up of Hainan International Tourism Island. We will promote the construction of a demonstration city for innovation and development of marine economy and start the construction of a demonstration zone for marine economic development.

Promote the project to land. The construction of coastal industrial park in Malacca, Malaysia has been stepped up. The operation capacity of Gwadar Port in Pakistan has been improved, and the construction of port free zone and investment promotion have been steadily advanced. Progress has been made in the integrated development of "Port+Park+City" in kyaukpyu, Myanmar. The second phase of Colombo Port City and Hambantota Port in Sri Lanka was promoted in an orderly manner. The Ethiopia-Djibouti railway has been completed and opened to traffic, and the Mombasa-Nairobi railway in Kenya is about to open to traffic. Piraeus Port in Greece has been built into an important transit hub port. China has cooperated with the Netherlands to develop offshore wind power, and cooperation projects on seawater desalination with Indonesia, Kazakhstan, Iran and other countries are being implemented. The level of submarine communication interconnection has been greatly improved, and the Asia-Pacific direct submarine optical cable (APG) has been officially put into operation. Remarkable achievements have been made in the construction of overseas parks such as China-Malaysia Qinzhou-Guan Dan "two countries and two parks", Sihanoukville Special Economic Zone in Cambodia and Suez Economic and Trade Cooperation Zone in Egypt.

Looking forward to the future, the China Municipal Government is willing to work with countries along the route with confidence and sincerity to promote maritime cooperation in the construction of the Belt and Road, share opportunities, meet challenges together, seek common development, act together, cherish the shared ocean, protect the blue homeland, and jointly promote the grand blueprint of the Maritime Silk Road in the 21st century.