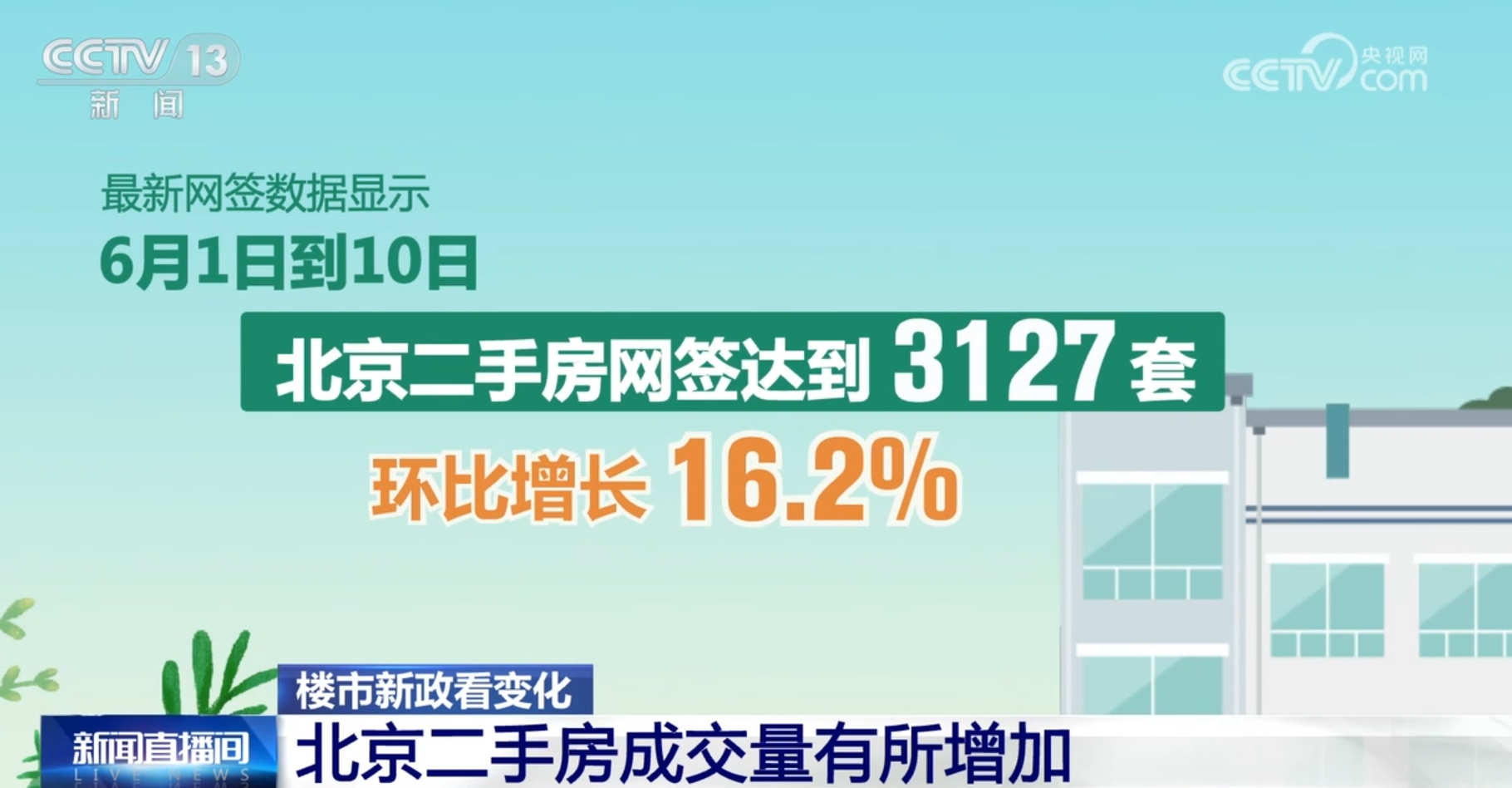

CCTV News:To pay attention to the property market. In May, a number of real estate policies, including lowering the down payment ratio and canceling the lower limit of loan interest rate, were intensively introduced, followed by many cities that followed suit to optimize and adjust local real estate policies. At present, the policy has been implemented for some time. What is the market reaction? In Beijing, the latest data shows that the transaction volume of second-hand houses in Beijing has increased since June due to the influence of policies.

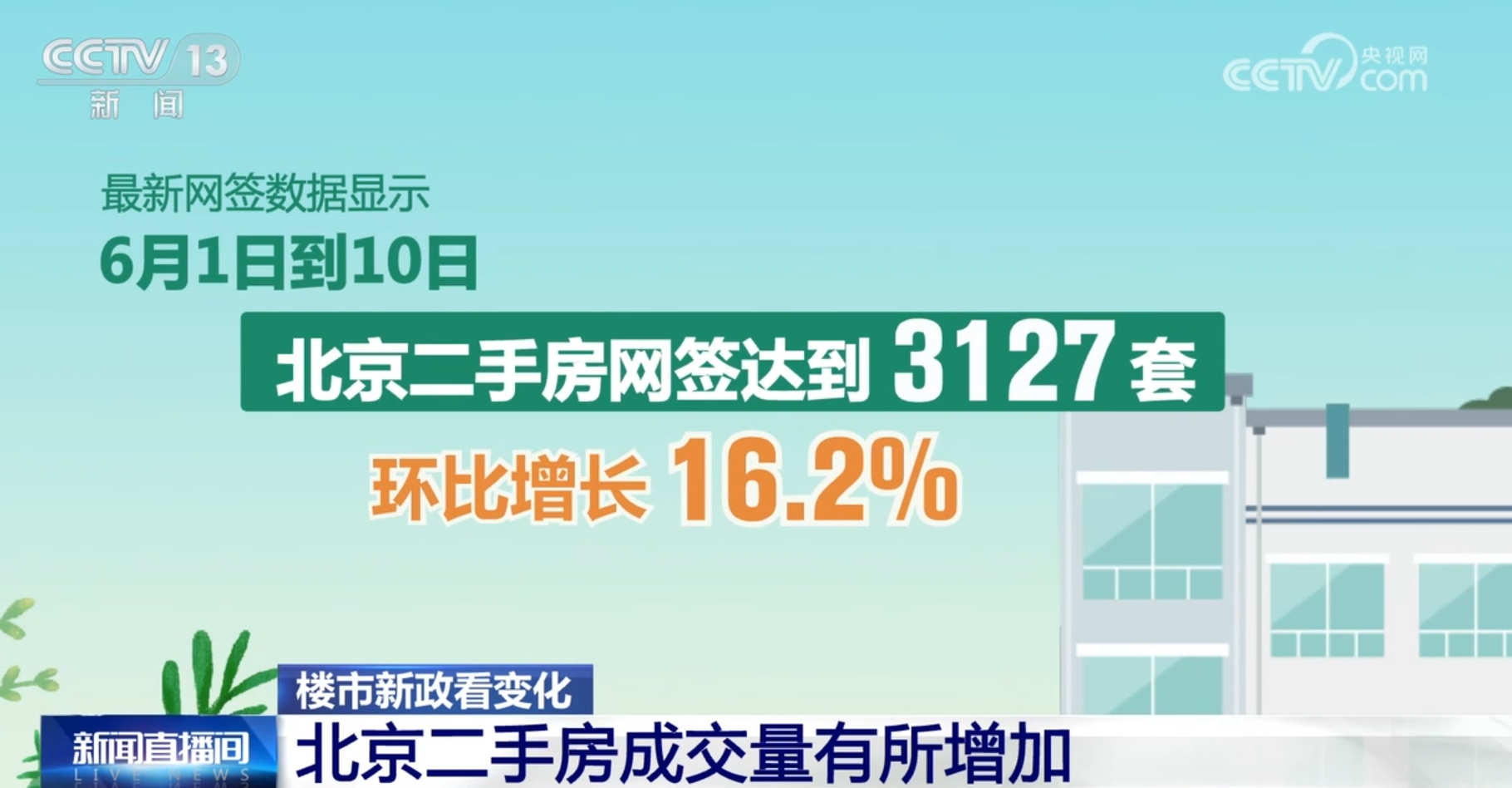

The reporter visited and found that the transaction volume of the second-hand housing market in Beijing recently showed signs of enlargement. In May, the number of online signs of second-hand housing in Beijing reached 13,383, up 3.1% compared with the same period in May last year. In June, market transactions have a further warming trend. According to the latest online signing data, from June 1 to 10, the number of online signing of second-hand houses in Beijing reached 3,127, an increase of 16.2% from the previous month.

Zhao Xiuchi, a professor at the School of Urban Economics and Public Administration of capital university of economics and business, said: "The market turnover has been slightly enlarged, the market has begun to pick up, and popularity has begun to gather. This is the superposition effect of a series of new policies, and the follow-up data may be better."

At the end of April, Beijing adjusted the purchase restriction policy, so that families who have reached the limit can buy an additional house in the Fifth Ring Road. This is the first time that Beijing has relaxed the policy after implementing the purchase restriction policy for many years.

According to industry insiders, since May, the second-hand housing market in Beijing has been generally positive. The number of people looking at houses and the number of contracts signed have increased compared with before, and the growth rate outside the Fifth Ring Road is higher than that inside the Fifth Ring Road. According to the data of Beijing’s largest real estate agency, the number of second-hand housing visitors increased by about 11% compared with the same period of last month, and the contracted volume increased by nearly 32%, among which the transaction volume outside the Fifth Ring Road increased by nearly 37%. Due to the lag of online signing, from the intermediary transaction data in May, the number of online signing of second-hand houses in Beijing may continue to rise in June.

Professor Zhao Xiuchi said: "In the future, with the further reduction of the threshold for buyers to enter the market and the burden of buying houses, we will continue to support the demand for improved housing. I believe that under the superposition of a series of favorable policies, more potential market demand will be released and the market will continue to warm up."

Cancel the maximum price of land, Shanghai property market shows positive changes.

At the end of May, Shanghai announced the implementation of nine real estate optimization and adjustment measures, involving policies such as lowering the social security threshold for foreign household registration and the eligibility of families with many children to buy houses. Since then, the relevant land policies have been adjusted. With the support of a series of policies, the volume of second-hand housing in Shanghai has gradually increased recently, and the popularity of the new housing market has risen, and the market has undergone positive changes.

Recently, Shanghai released the third batch of residential land transfer announcements this year. The land transfer made a major adjustment to the bidding rules, canceling the upper limit requirement of 10% premium rate of commercial residential land. Simply put, it is to cancel the limit of the highest premium rate, let the market determine the land price, and implement the "highest price wins" in land transfer.

Yan Yuejin, research director of Yiju Research Institute, said that the cancellation of premium rate in Shanghai this time is actually an implementation of the "Shanghai Nine Articles" policy, and it is also an adjustment of the overly strict policy in the past overheating period, which fully shows that the current land market has entered the direction of "market belongs to the market and guarantee belongs to the guarantee", which has also greatly promoted the confidence of housing enterprises in land acquisition.

From the market point of view, since the announcement of nine real estate adjustment and optimization measures in Shanghai, buyers and sellers have become more active. The reporter saw in a real estate agency store in Songjiang District that because there were too many people looking at the house, except one or two brokers in the store were responsible for guarding the store, and other brokers went out to show the buyers the house.

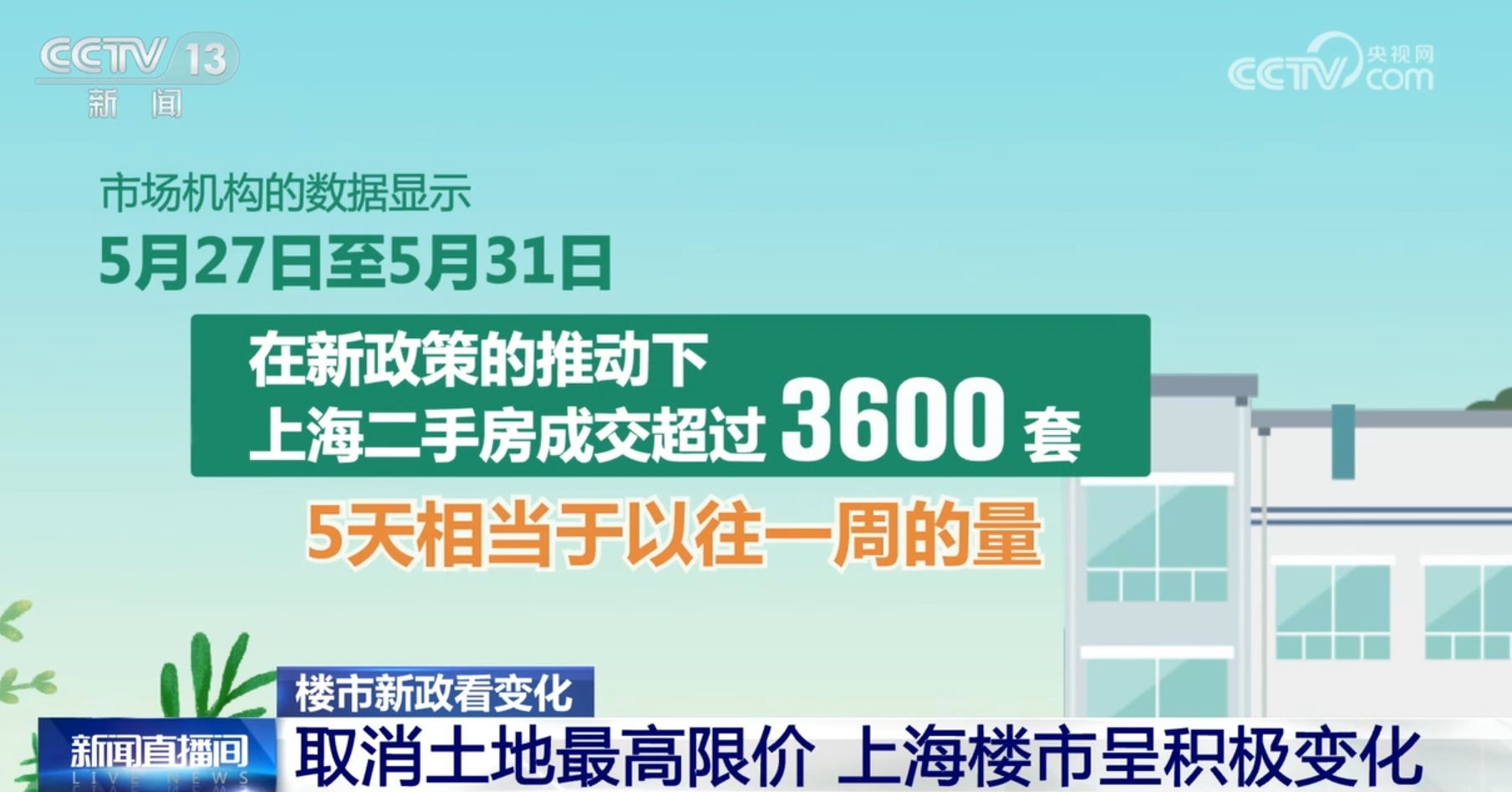

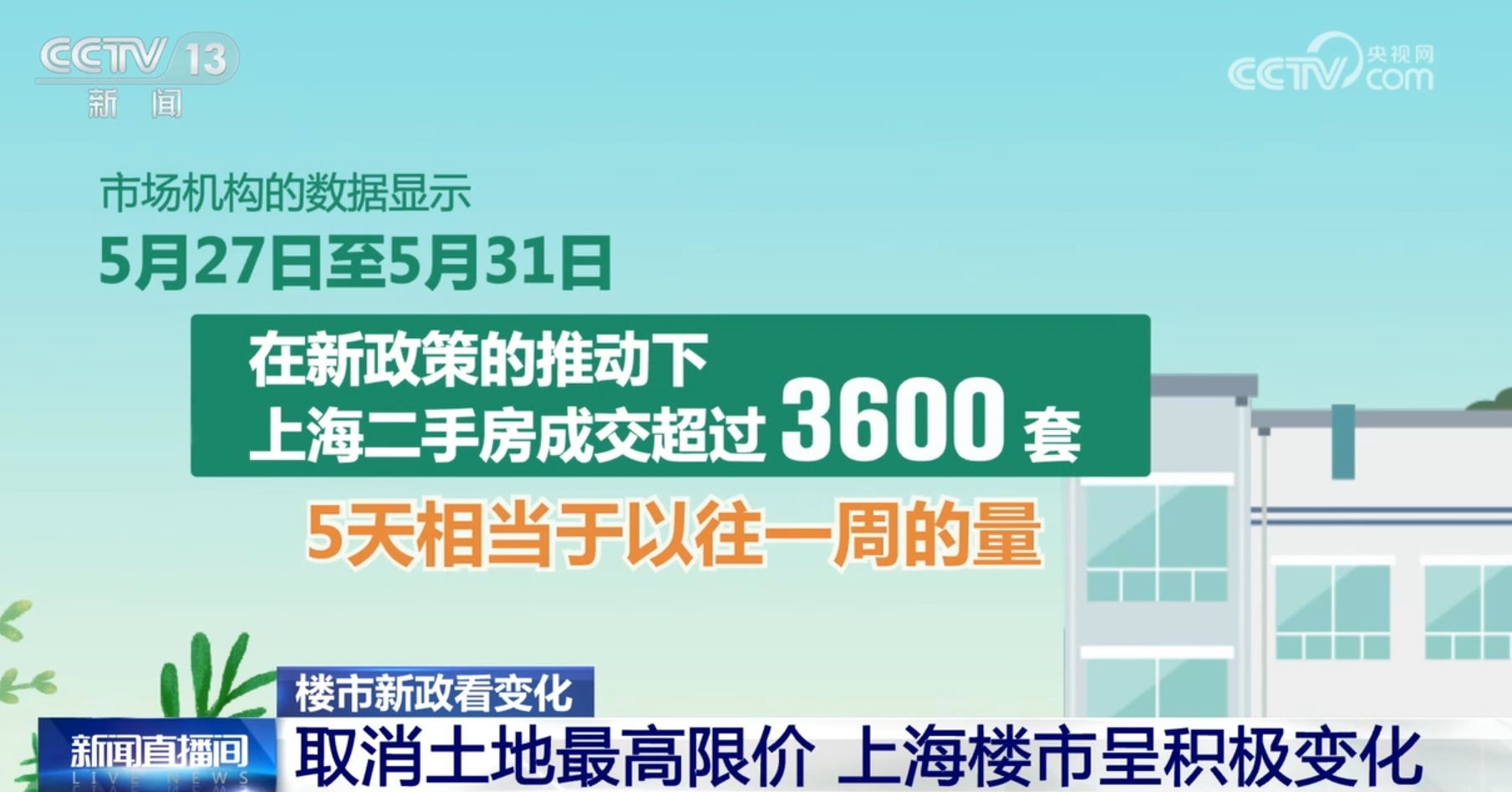

According to the data released by official website, Shanghai Real Estate Trading Center, the transaction volume of second-hand houses in Shanghai in May was 18,692 sets, with an average of 602 sets per day, showing a trend of stopping falling and rebounding. Among them, the data of market institutions show that from May 27th to May 31st, driven by the new policy, Shanghai sold more than 3,600 sets of second-hand houses, which was equivalent to the previous week’s volume in five days. Since June, the number of online signs for second-hand houses has also continued to increase, reaching 902 sets on June 6 and 968 sets on June 7.

Song Xiaojuan, a senior manager of a real estate agency, said: "A combination of this policy at present is actually very helpful to improve the confidence of the whole market."

Not only the second-hand housing market, but also the new housing market in Shanghai has recently warmed up significantly. The reporter saw in a new house in Songjiang District that there were many citizens who came to see the house in front of the sand table of the sales office.

According to the person in charge of sales, since the implementation of the New Deal on May 28, the project’s popularity has increased, and the volume of transactions and customer visits have increased by nearly 40%, and the market has obviously been positive.

Guangzhou market activity has been significantly boosted.

At the end of May, on the second day after Shanghai released the New Deal on the property market, Guangzhou also introduced policies to optimize and adjust the property market, including lowering the down payment ratio of the first suite to 15% and canceling the lower interest rate limit. After the policy adjustment, the activity of the market began to increase significantly.

There are more people looking at the house, which is the most obvious feeling of many intermediaries in Guangzhou these days. In a real estate agency store in Tianhe District, Guangzhou, the staff told reporters that in just a few days after the introduction of the New Deal, the number of first-hand houses and second-hand houses has been greatly improved.

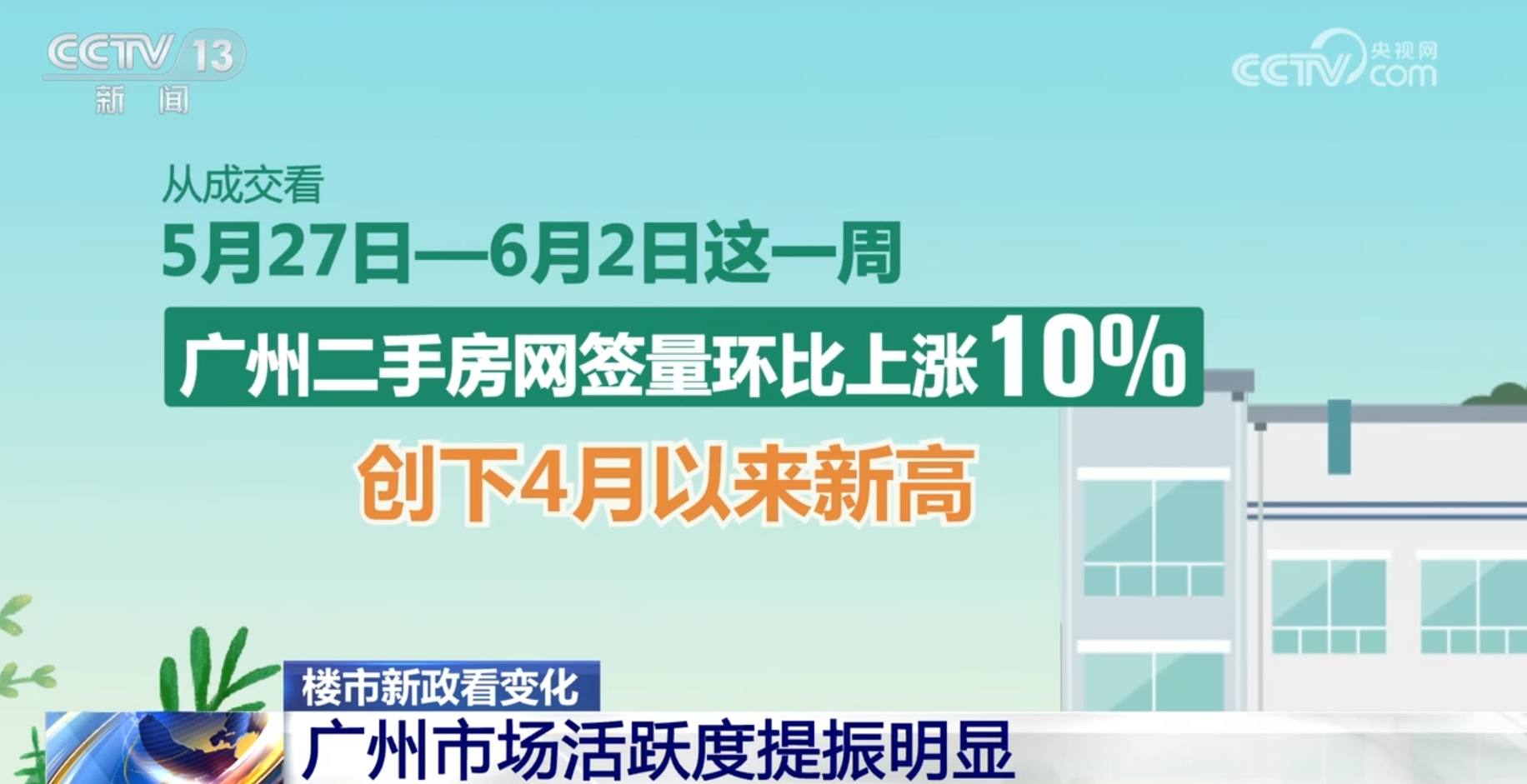

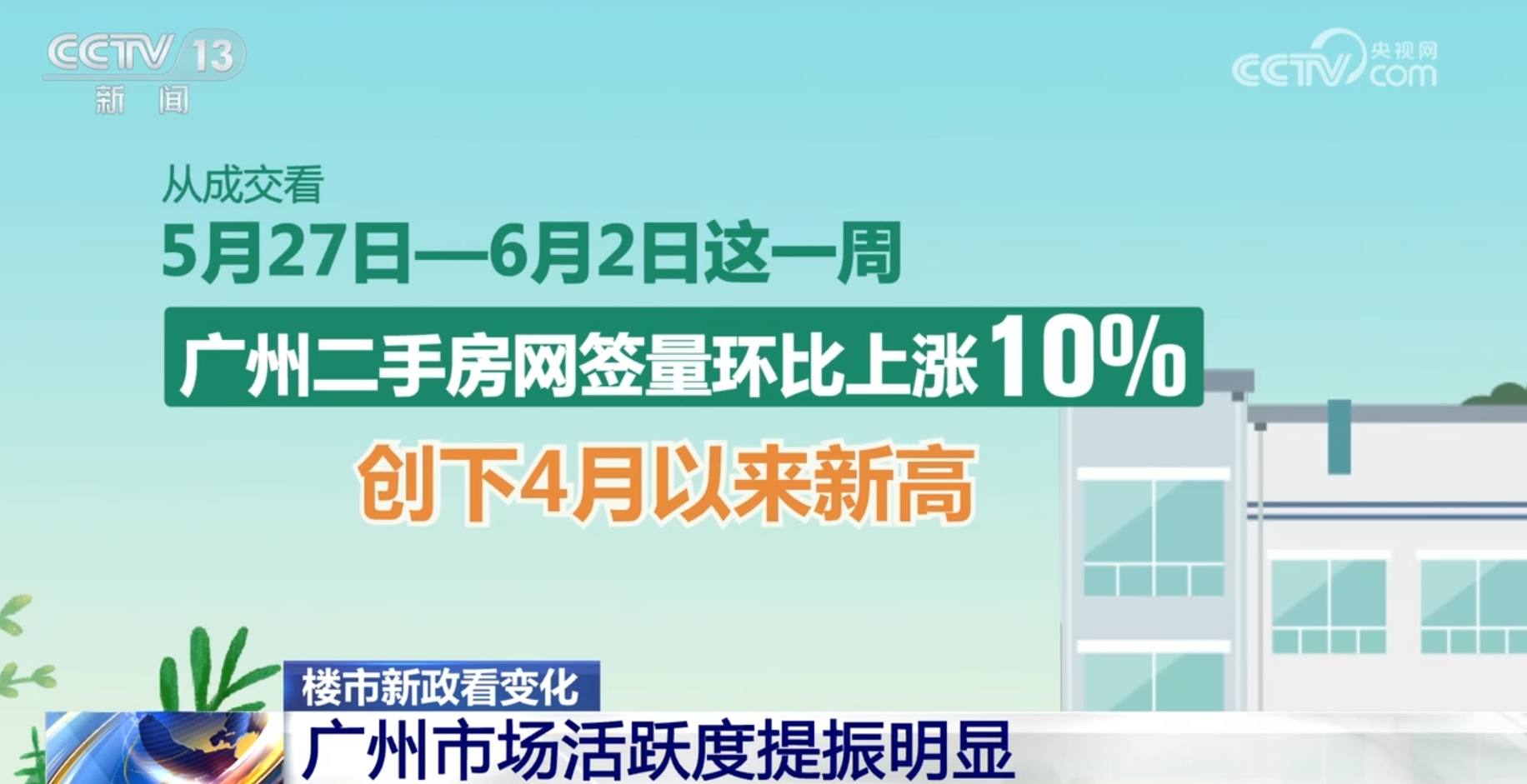

According to the statistics of an intermediary agency in Guangzhou, on Sunday, June 2nd, the number of people looking at houses in Guangzhou has reached 3,981, up by about 17.4% month-on-month, and the total number of people looking at houses has reached 17,907 times, which is equivalent to each customer seeing about 4.5 suites on Sunday. From the transaction point of view, May 27th — In the week of June 2, the number of online signing of second-hand houses in Guangzhou increased by 10% month-on-month, setting a new high since April.

According to industry insiders, the policy announced by Guangzhou this time exceeded market expectations. At present, the observation time is too short to fully reflect the policy effect. I believe that after a while, with the further release of the policy effect, the market activity will be further improved.

Foreign-funded institutions: China real estate market will develop more stably.

With the implementation of various real estate adjustment and optimization measures one after another, the reporter noted that recently, foreign-funded institutions such as Goldman Sachs and Morgan Stanley began to actively pay attention to the real estate industry in China, and their attitudes towards the real estate sector in China changed.

Recently, Xing Ziqiang, chief economist of Morgan Stanley in China, said that the People’s Bank of China set up a refinancing loan for affordable housing, which can not only reduce the inventory of the real estate industry, improve the liquidity problem of developers, better promote the implementation of the property guarantee, but also help reduce preventive savings, thus stimulating real estate consumption. Lin Zhenhong, head of China Mainland and Hongkong Real Estate Investment Research Department of UBS, and Song Yu, chief China economist of BlackRock, also believe that the increasing support of real estate policies has increased investors’ confidence to a certain extent, which is conducive to stabilizing the real estate market. Lu Ting, chief economist of Nomura Securities, made it clear that he saw the hope of clearing the risks in the real estate market, and then saw the hope of macroeconomic stability and even comprehensive recovery.

Yan Yuejin, research director of Yiju Research Institute, said: "In the near future, foreign investment banks have expressed very good attitudes and expectations for China real estate and the overall economic situation, and they are all optimistic about the current situation of China real estate market stabilizing and recovering. At present, some attitudes of major investment banks have turned, and they hold a more positive and optimistic attitude. It should be said that it largely explains some new changes in the current real estate market. "

In addition to policy support, the improvement of market sales data is also one of the important reasons for foreign-funded institutions to pay attention to China real estate market again. Relevant statistics show that since the beginning of this year, the sales volume and sales area of China real estate market have increased to varying degrees. Especially in some first-tier cities and hot-spot second-tier cities, real estate sales have obviously picked up, which has provided strong support for the overall recovery of the market.

With foreign investment actively doing more real estate sectors, the volume of real estate sectors has soared recently, and the turnover of industry sectors has continuously hit a new high. Corresponding to the surge in the real estate sector, well-known foreign-funded institutions have increased their holdings of some real estate stocks and frequently appeared in the research list of real estate enterprises.

Yan Yuejin, research director of Yiju Research Institute, said: "From the voices of some investment banks and overseas institutions and some recent attitudes, it fully demonstrates the recognition, support and affirmation of the real estate market in China. After experiencing this market adjustment, the current real estate market should be said to develop in a more stable and better direction. "