Be sure to get the aero engine up!

Wen | Xiong Wenming

This article is reproduced from WeChat WeChat official account’s "Taihe Industry Watch" (ID: taifangwu). The original article was first published on February 25, 2021 with the title "China Aero-Engine Breakthrough in All Sides", which does not represent the viewpoint of Outlook Think Tank.

Ren Zhengfei told a story: In the 1970s, British Rolls-Royce offered to sell their Spey engines to China, and were willing to sell military engines directly. The Chinese side in charge of the negotiation was overjoyed and wanted to pay tribute to the British scientists, but the British scientists said, "Thanks to the great inventions of China scientists". When China comes back, find out which scientist it is, Wu Zhonghua. Where is he? Raising pigs in Hubei. Then hurry back to Beijing to be the director of the Institute of Thermophysics.

This is a dramatic story, which was later proved to be somewhat different from reality. But what is certain is that,The three-dimensional flow technology of Spey engine is indeed based on the "three-dimensional flow theory of turbomachinery". In 1950, Wu Zhonghua read a paper at the annual meeting of the American Society of Mechanical Engineers in new york, and formally put forward this theory, which was later defined as "Wu’s general theory" and the basic equation in the theory was called "Wu’s equation". Wu Zhonghua’s lecture video was once used as a training material by NASA.

Ren Zhengfei felt that if we had followed Wu Zhonghua’s basic theory and made continuous breakthroughs in engineering technology, the situation of aero-engines in China today might be more optimistic.

In December 2020, the US Department of Commerce published a new list of "military end users", and 80% of the 58 China companies were related to aviation. This is not a sudden bad news. As early as the beginning of 2020, rumors of an embargo on commercial aircraft in China once triggered domestic concerns that the supply of C919 engines might be cut off. From beginning to end in 2020, the focus of American sniper will be China’s aviation industry, especially engines.

As the heart of an airplane, aero-engine is one of the most complicated engineering technologies of human beings so far.At present, many countries can build airplanes, but only the five permanent members of the United Nations, namely, the United States, Russia, Britain, France and China, can really independently develop aero-engines.

China’s aero-engine construction began in the 1950s, and it has gone through a tortuous road from imitation and improvement, to partial independent research and development, and then to completely independent research and development.

At the beginning of the 21st century, with the implementation of "two-engine special project" and the establishment of China Hangfa, the development of aero-engines in China began to enter the fast lane of catching up.In the direction of military aviation development, the self-developed "Taihang" series engines have been put into production in turn, gradually getting rid of import dependence. In the civil direction, CJ-1000A, the "Yangtze River" engine supporting C919, has entered the trial production stage, and CJ-2000 of 35-ton class has also achieved the ignition test of the core engine in 2020, and it is said that the first verification machine has been assembled.

Since the 1990s, China’s reflections and discussions on aero-engines have come and gone, and they have continued to this day. The problem has long been found, but the difficulty lies in how to solve it.

Taking the "two-aircraft special project" and the establishment of China Airlines as milestones,China has started a breakthrough from technological innovation to institutional innovation.

one

From "if there is nothing" to "cohesive development"

In 1958, Wu Daguan, known as the "father of aero-engines" in China, took the opportunity of visiting Britain and made a special trip to the Soviet Union on his way home. He wanted to ask the Ministry of Aviation Industry of the Soviet Union for verification.

After it was rumored that the Soviet Union successfully launched the world’s first artificial satellite, Khrushchev excitedly declared that planes would enter museums in the future.It means that with missile technology, airplanes are useless.. This argument spread to China, which triggered a heated debate at the decision-making level. At that time, China had copied the first turbojet engine turbojet -5 according to the Soviet BK-1φ in Shenyang Aero-Engine Factory, and the jet fighter J-5 with this engine also rushed into the blue sky in Shenyang Aircraft Factory.

Will we develop our own engine next? Fortunately, the ministers of the Soviet aviation industry reassured him: in war, although missiles have great lethality, they really have to rely on planes to conquer each other. Therefore, the United States has not stopped engaging in fighter planes, and our Soviet Union is still engaged in MIG -21.

In the early days of the founding of New China, its national strength was weak, so it could only give priority to the development of critical science and technology. In the debate on "giving priority to the development of aircraft or missiles", Qian Xuesen put forward the "Opinions on Establishing China’s National Defense Aviation Industry" to the Central Committee, advocating concentrating on the development of rockets and missiles.

After a series of investigations and discussions, the central government regards aerospace as a whole and focuses on breaking through missiles and rockets first.In the end, "two bombs and one satellite" laid the foundation of China’s international status and security, and also proved Qian Xuesen’s vision.

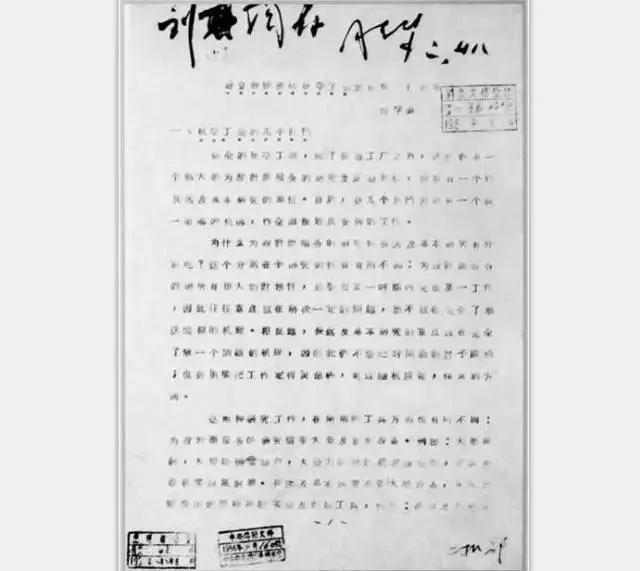

In February 1956, Qian Xuesen submitted to the Central Committee "Opinions on Establishing China’s National Defense Aviation Industry"

However, for a long time after the breakthrough of rocket technology, there was no overall planning for the development of aviation industry, which led to the lack of strategic traction in the independent research and development of aircraft, especially aero-engines.

Political circles are still debating whether the aviation industry belongs to high and new technology. Until 1995, when the Ninth Five-Year Plan was released, aviation technology was still not included in high and new technology. Many scientists began to worry. Seven respected and old experts, including Wang Daheng and Shi Changxu, signed a letter to state leaders to express their feelings.

Experts put forward two reasons for vigorously developing aviation technology: First, the Gulf War proved that air power still plays a decisive role in modern wars; Second, the development of aviation industry plays an obvious role in driving the national economy.Experts believe that the gap between China’s aviation technology and advanced countries is widening day by day. If it is not developed vigorously, there will not only be a military crisis, but also the huge domestic civil aviation market will be occupied by foreigners in the future.

For aero-engines, Academician Wang Daheng, the winner of the medal of "two bombs and one satellite", used the word "free" to describe it. Free does not mean nothing, but it is sometimes absent and looming.

"Free" means insufficient investment.China’s first self-designed turbofan -6 with large thrust engine lasted for 20 years, with a total development cost of 150 million RMB, and only 2 million RMB was available in two years at the critical stage of development. At the same time, it cost about $2 billion to develop an engine for an ordinary large and medium-sized aircraft in the United States.

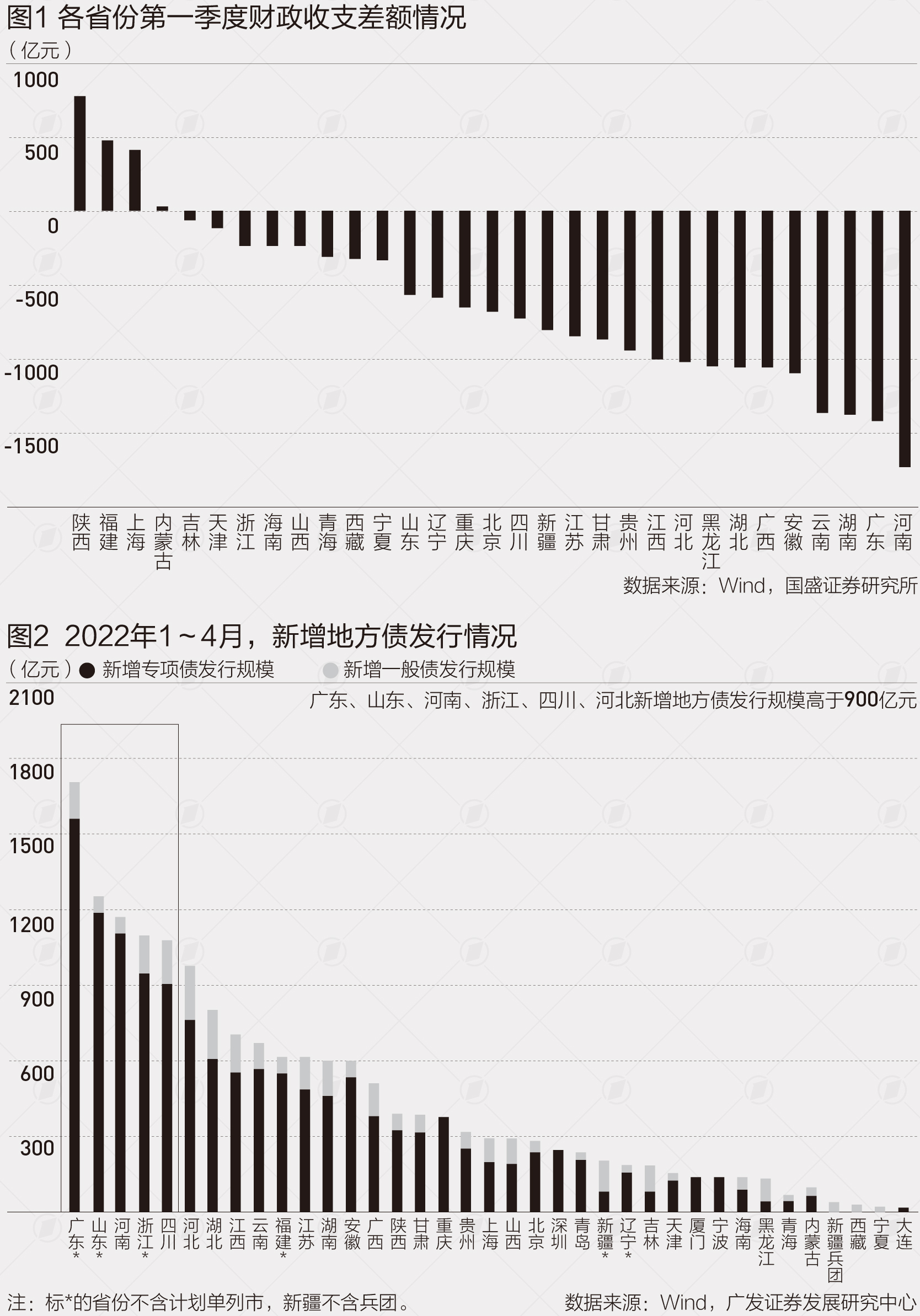

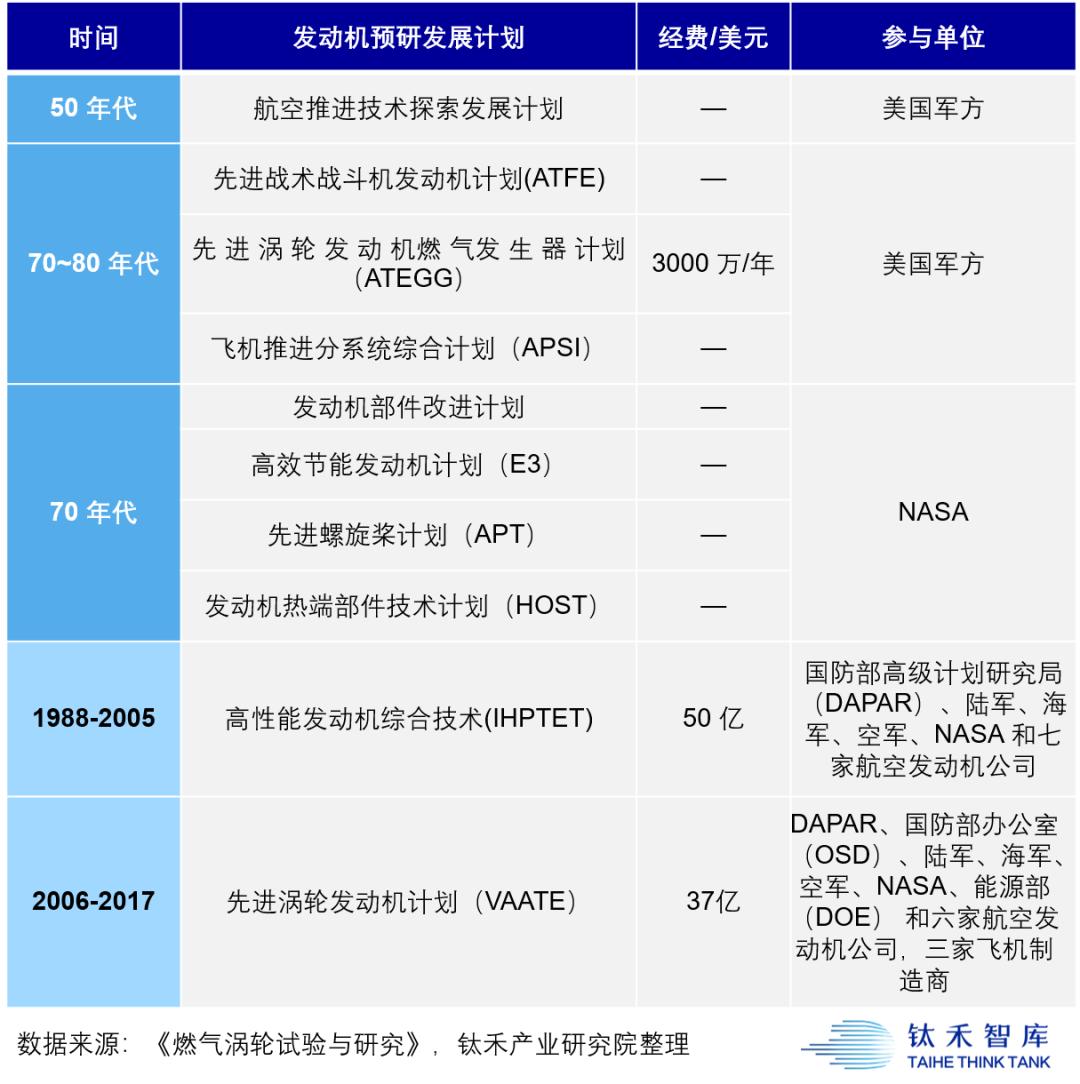

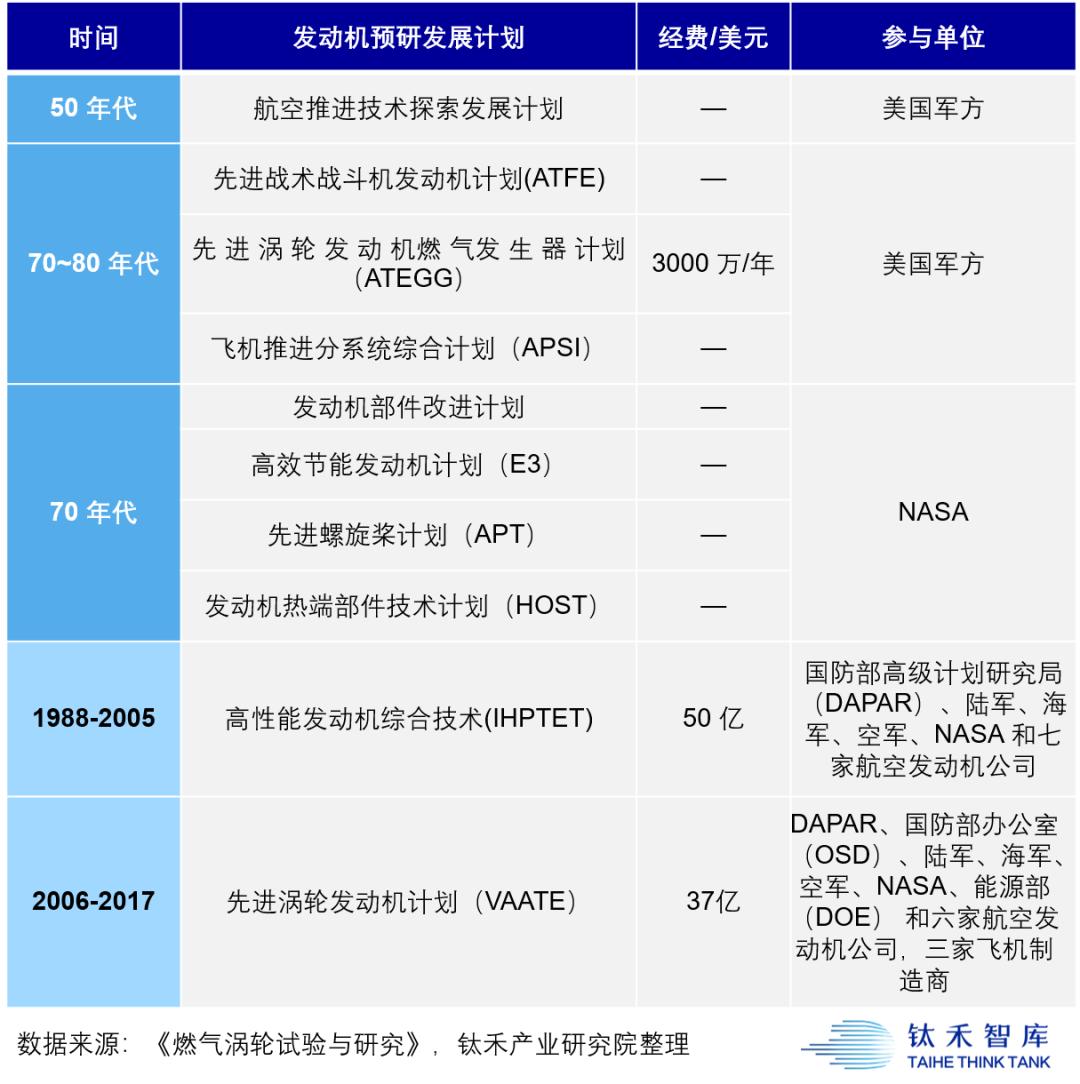

In the 1980s, the United States successively put forward pre-research projects such as IHPTET (Integrated High Performance Turbine Engine Program) and VAATE (Advanced Turbine Engine Program), and invested 5 billion and 3.7 billion US dollars respectively. China also put forward two pre-research plans for high-performance engines in the 1980s, but the total investment in 20 years is only equivalent to that of the United States in one quarter. Even if the purchasing power of money in the same period is taken into account, the gap between them is huge.

Aeroengine pre-research program in the United States

It was not until more than half a century passed that we had a deeper understanding of the strategic value and complexity of aero-engines. Since 2011, the Ministry of Industry and Information Technology has taken the lead in investigating and demonstrating aero-engines and gas turbines. In 2012, the "two-machine special project" was approved. In March 2016, in the 13th Five-Year National Science and Technology Innovation Plan issued by the State Council, aero-engines and gas turbines ranked first.

The implementation of the "two-engine special project" means that aero-engines as a major national strategic project will receive strong support from policies, funds and resources at present and in the future, and fundamentally solve the problem of insufficient investment.

By the end of 2020, the investment in the "two-machine special project" has reached 300 billion yuan. With the strong support of policies and funds, China’s aero-engine and gas turbine technology is accelerating to catch up with the world’s advanced level and achieve a historic leap.

2

From "Aircraft Dependence" to "Flight Separation"

"There are no planes, what do you need an engine for?"

In 1982, due to the changes in the equipment system of the National Air Force, the J -9 and J -6 planes were planned to be dismounted one after another. As its supporting power, the turbofan -6 engine is also facing dismounting because it suddenly loses its applicable object, and at this time, the turbofan -6 has gone through.18 years of hard development, just passed the 24-hour pre-flight test run. From the beginning of scheme research in 1964 to the end of development in 1984, turbofan -6 lasted for 20 years, which almost condensed the youth of a generation. According to the relevant personnel’s memories afterwards:

"At the moment when the suspension of development was announced, Wu Daguan burst into tears, and he also cried on stage."

The development was terminated due to the dismounting of the plane, and the turbofan -8 was developed by Shanghai Changzheng Machinery Factory. This large thrust civil aviation engine, which was born for Yun -10 aircraft, was successfully tested on Boeing 707 for more than a dozen times, and flew to Lhasa and other places as the heart of Yun -10. The cumulative flight time was 170 hours, and all the performances met the design standards. In 1985, Klebos, vice president of the General Aviation Engine Division of the United States, visited China and once admired the turbofan -8:

It was indeed a great achievement that you could finish such a complicated engine 10 years ago.

Turbofan -8 stopped production with Yun -10 dismounted.

Frequent dismounting of projects not only discourages the enthusiasm of researchers, but also delays the development opportunity.For a long time, the development path of aero-engines in China was "maintenance-mapping imitation-model improvement-model development-pre-research", which was basically the opposite of the path in the United States. At that time, the United States had established a mature pre-research mechanism and took a steady route of "technical pre-research-core machine-test verification".

In 2001, Wu Daguan pointed out in his article Reflections on Two Major Historical Issues of Aviation Industry,The policy of "scientific research first, power first" formulated by the aviation industry has not been agreed and implemented, and in fact it has become a general slogan.

One of the fundamental reasons why the pre-research could not be carried out was that the development of the engine was subordinate to the aircraft at that time, that is, "one factory, one model". If a factory wants to develop an airplane, there will be a research institute to develop a matching engine.The engine followed the plane, the plane project dismounted, and the engine development stopped.

On the other hand, due to the long-term lack of technical reserves and pre-research, the development cycle of aero-engine is much longer than that of aircraft, and aircraft often can’t afford to wait for the engine, so it is better to buy others’ ready-made products for independent development. Academician Liu Daxiang, an aviation power expert, once reflected on this issue:

"For a long time, too much emphasis has been placed on aircraft with engines and models with pre-research, and insufficient attention has been paid to early technical verification. Many key technologies have not been effectively broken before model establishment, and often model development is synchronized with technical research and component troubleshooting, resulting in repeated model development, which greatly delays the development cycle."

Under the collective reflection of aviation industry experts, the call for "separation of flight and development" continues to rise. In 2009, China Hangfa Commercial Aviation Engine Co., Ltd. (hereinafter referred to as "China Hangfa Commercial Engine") was established, becoming the general contractor of China’s large passenger aircraft engine project, and began to develop China civil aviation engine.

In 2016, China Aviation Engine Group Co., Ltd. (hereinafter referred to as "China Hangfa") was formally established, which was jointly funded by SASAC, Beijing State-owned Capital Management Center, China Aviation Industry Corporation and China Commercial Aircraft Corporation.

Since then, China has owned a national specialized aero-engine enterprise group.It means that, at least institutionally, aviation development has completely got rid of the dependence on aircraft development., towards the independent development of the sea of stars.

three

From "Imitation of Surveying and Mapping" to "Independent Research and Development"

"Buy if you can, and copy if you can’t."

The background of Ren Zhengfei’s story is the 1970s. In fact, the introduction of "Spey" engine from Britain was just an accidental episode. In the early days, most aero-engines in China came from mapping and imitation of Soviet engines. As the core technology of aviation industry, the western countries have always adopted a blockade strategy against China. After the Soviet Union cut off aid, China’s aviation industry once fell into a dilemma of no availability. In 1972, British Rolls-Royce offered to provide Spey MK202 engine to China, and at the same time transferred technology, which was quite unexpected.

Spey MK202 engine

In December 1975, China and Britain signed a purchase contract of about 77 million pounds.The original plan is divided into two steps. It will take three years to learn how to assemble qualified Speer with imported parts, and then five years to realize localization.. In 1980, the Spey engine developed and assembled according to British wool was tested in Britain. However, in the national economic adjustment in the 1980s, it faced the same reality as turbofan -6, so the localization process was suspended for more than ten years.

It lasted for 30 years before and after the localization of Spey, which is very emotional. Because we couldn’t wait for the engine, in order to ensure the production of the aircraft, we first used the Spey engines stored for 20 years, and then bought a batch of second-hand engines from Britain. Until around 2010, turbofan -9 finally kept up with the progress and realized continuous mass production supply.

The turbofan -9 "Qinling" engine developed from Sibei belongs to "partially independent design". Before that, most of us were "copying and improving" Soviet engines.Long-term measurement and imitation lead to the fact that the technical ability of the institute is even inferior to that of the factory, and the technology cannot be digested and its own research and development system cannot be formed.

It was not until 2002 that the domestic turbojet -14 "Kunlun" engine was finalized that China completed the whole process of self-development for the first time.

In December 2005, the domestic turbofan -10 "Taihang" developed by Shenyang Liming Engine Company passed the life test and became the first large thrust turbofan engine with independent intellectual property rights in China. "Taihang" took 27 years from the pre-research in 1978 to the project establishment in 1987, and then to the completion of the design finalization examination at the end of December 2005. This process can be said to be stumbling, and even the explosion of the testing machine occurred.

Until 2011, the maximum afterburner thrust of turbofan -10 was determined to be 125KN, which means that this "domestic heart" with high hopes has finally entered the mass production state. "Taihang" has finally passed the stage of being criticized by netizens as "not very good", and its performance in recent years can be regarded as disappointing. Up to now, no fighter plane carrying "Taihang" has crashed due to engine failure.

From imitation and improvement, to partial independent research and development, and then to having independent intellectual property rights, China aviation industry people clearly realize that key areas must be self-reliant and core technologies must be mastered by themselves.However, as the most complex industrial field of mankind, the development of aero-engines cannot be done behind closed doors.

The development of turbofan -10 has also learned from others’ strengths. For example, the core engine principle draws lessons from the F-110 commonly used in the United States. In order to meet the actual domestic installation demand, Su -27 was introduced as a flight test platform, and a lot of technical experience of the supporting power system AL-31F of Su -27 was digested and absorbed. Like many domestic equipment technologies in China at present, turbofan -10 does not copy Russian products or blindly follow hairdressing, but absorbs the experience of the United States and Russia at the same time, and then explores a technical route that conforms to China’s reality.

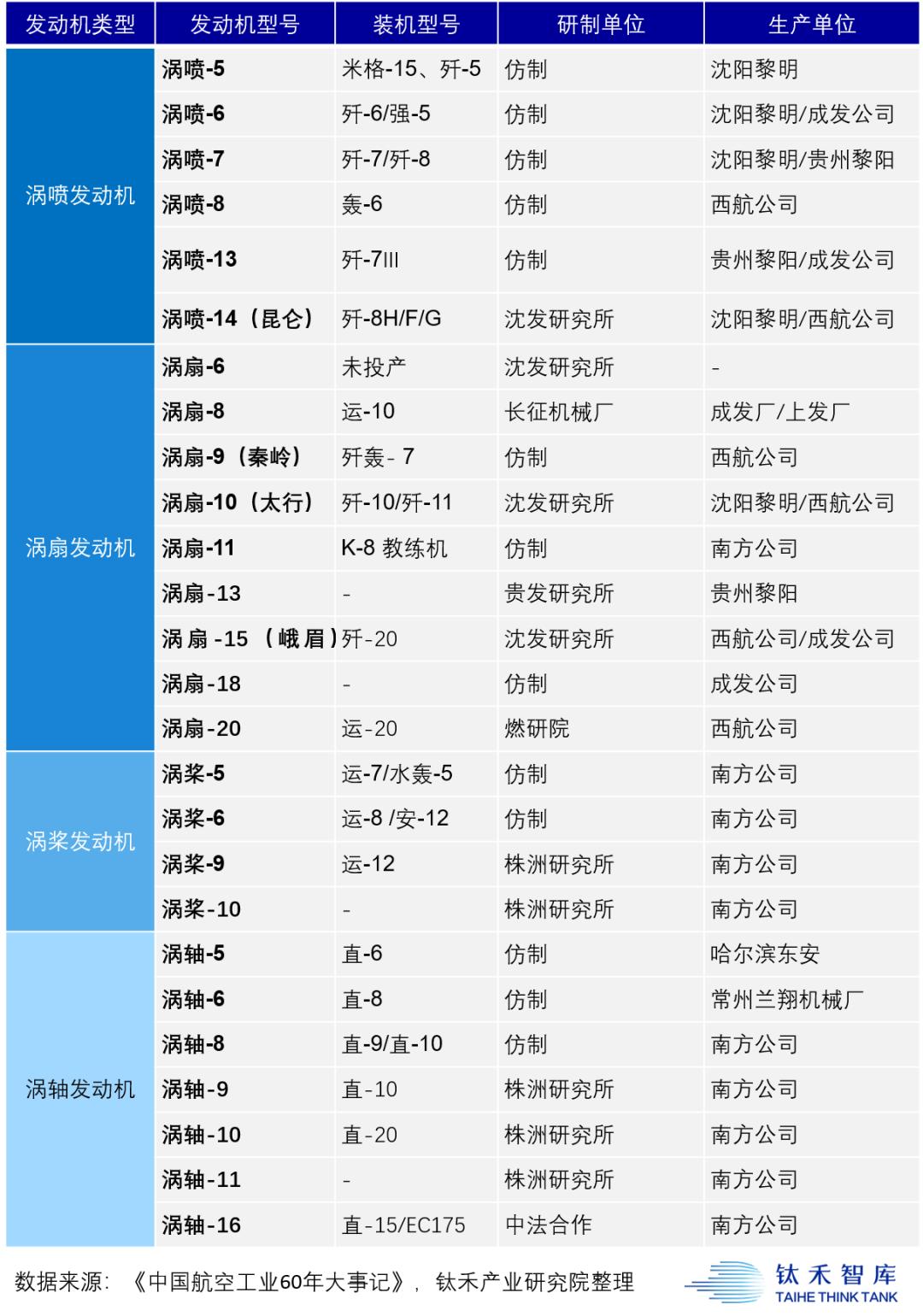

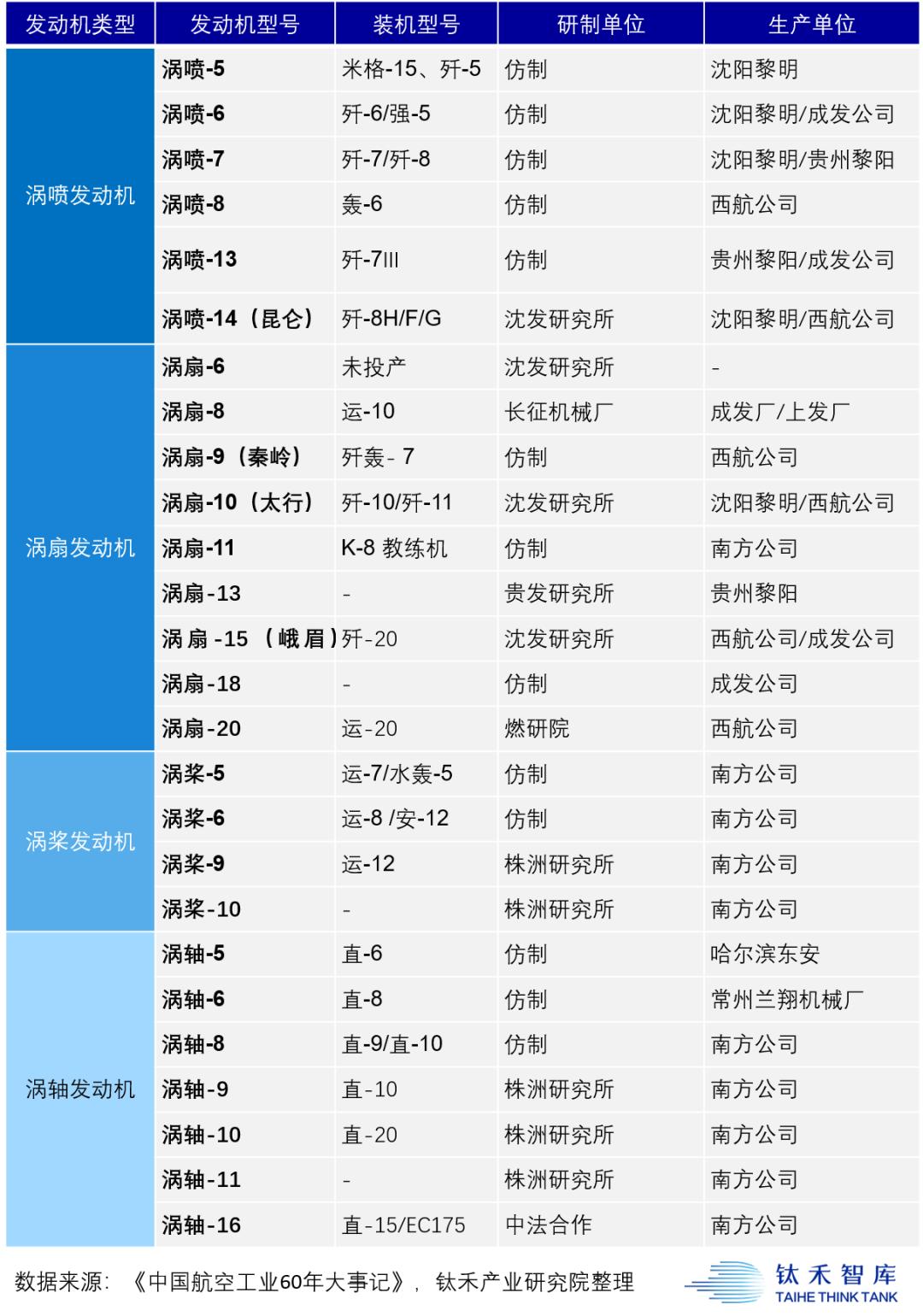

Main military aero-engine models developed in China.

From "filling in the blanks" to "looking back", it is not easy to finally ensure that it is "neck and neck" with developed countries.After the establishment of China Hangfa, a "three-step" road map was established.

The first step is to narrow the gap with the advanced level of foreign aero-engines, initially establish an independent innovation research and development system for aero-engines, and lay a foundation for development;

The second step is to basically build an independent innovation research and development system for aero-engines;

The third step is to complete the independent development process of representative models, build the basic research, product development and industrial system of independent innovation, basically realize the strategic transformation of independent innovation and development, and make China Hangfa an innovative enterprise with international competitiveness.

four

From "Closed Independence" to "Open Integration"

"Small core, great collaboration, specialization and openness."

In the first half century, the development of aero-engines in China was not smooth. From the 1990s to the beginning of this century, there were many reflections on the lagging development of aero-engines in China.The old experts concluded that "our understanding of the development law of aviation technology is insufficient, and we lack long-term planning and stable planning", but the deeper reason lies in the system.

The American military industry model is based on enterprises.Boeing, Loma, Nuoge and other dual-use groups are the main manufacturers, Raytheon, Holwell, Pratt & Whitney, General Motors and other groups provide sub-system support for them, and thousands of dual-use enterprises such as TI and ADI are responsible for supplying materials and parts, forming a pyramid-shaped integration of defense and civilian technologies ecological circle with open cooperation, step-by-step competition and professional subdivision.

During the Cold War, the United States once supported two aviation giants, GE and PW, through the horizontal competition mechanism controlled by the government. In 1968, the US Department of Defense asked Pratt & Whitney and GM to manufacture and test one engine each. This government-led "selecting the best to help the strong" has achieved remarkable results, and finally achieved the famous GM F-110 engine and Pratt & Whitney F-100 engine.

F110-GE engine

Pratt & Whitney initially won the competition and signed the contract first. Although GM was at a disadvantage in the initial competition, it subsequently launched an improved F110-GE-129, and Pratt & Whitney developed an improved F100-PW-229 to compete with it.

In February, 1984, the United States Air Force purchased F100 and F110 in proportion according to the double contractor procurement strategy, and basically they were exposed to rain and dew. It is under such a "horse racing" mechanism and order support that the two companies have grown into the world’s top aero-engine companies.

For a long time, China’s military industrial model is dominated by military industrial groups with strong administrative color, and scientific research tasks are coordinated, coordinated and protected in a highly planned way. The general research institute to the assembly plant, and the supporting research institute to the supporting plant are mostlyIn the state of "vertical cooperation and fragmentation", military and civilian lines are separated, forming a closed monopoly system with separation of research and development, lack of competition and self-protection.

The establishment of the "Two-Aircraft Project" and China Aviation Development Co., Ltd. is escorted by the in-depth promotion of the national integration of defense and civilian technologies strategy. In 2016, the Opinions on the Integrated Development of Economic Construction and National Defense Construction issued by the Central Committee of the Communist Party of China, the State Council and the Central Military Commission clearly proposed to deepen the reform of the national defense science, technology and industry system, further break the industry closure, expand the introduction of social capital, highlight core capabilities, liberalize general capabilities, promote socialized cooperation, and promote the professional reorganization of military enterprises.

Breaking the binary separation of military and civilian and promoting open integration are not only institutional breakthroughs, but also the reshaping and integration of the industrial chain.Taking the aviation industry as an example, the "main manufacturer-supplier" model that the United States has been pursuing is being followed by global aviation manufacturing enterprises. In this mode, the development of an aircraft requires the early intervention of suppliers and joint participation in research and development.

The main manufacturer splits its subordinate manufacturing units and becomes a system integrated manufacturing role, getting rid of the "heavy-load" link of "manufacturing production", which requires high load to produce benefits, and enhancing its ability to cope with market changes; Suppliers can focus on the research and development and technical strength reserve of a certain subsystem, so as to be more professional and efficient.

As the core system of an aircraft, aero-engine open cooperation can also greatly improve the development efficiency. For example, since 2004, Rolls-Royce Company has only produced 30% of the core components and the highest added value, and subcontracted the remaining 70%, thus reducing the manufacturing and purchasing costs of all engine parts as much as possible under the premise of controllable risks.

On this basis, China Hangfa has further determined the development mode of "small core, large cooperation, specialization and openness", which means that the development of China aero-engine can attract more extensive external forces to participate in the cooperation nationwide and even globally, and enterprises can concentrate on improving key core capabilities. According to the disclosed information, there are currently more than 350 suppliers participating in the "Yangtze River" series of engines, initially forming a global supply chain. At the same time, 69 suppliers from 16 countries are willing to participate in the commercial engine project in China.

Historical lessons have proved that you can’t build an engine behind closed doors.

Aeroengine is composed of tens of thousands of precision parts, which has a long development cycle and involves a wide range of fields. Independent research and development of aero-engines is an arduous challenge to the current basic disciplines, design, materials and technology. China has a complete range of manufacturing industries and abundant resources, but the support provided by basic industries is far from enough. Through open integration, the standards and data barriers in the upstream industrial chain (such as materials, machining, measurement and testing, etc.) can accelerate the integration of manufacturing resources, enrich and improve the industrial chain, and maximize the cost reduction and efficiency improvement of the whole industry.

Due to the historical debts and the current technical blockade, it is doomed that the breakthrough road of China aero-engine is still bumpy, which requires great determination, patience and wisdom. But the first light on this road has shown us the way.

References:

[1] Wu Daguan, thinking about two major historical issues of aviation industry, 2001.

[2] Yang Kemin, 100 people who moved China since the founding of New China: Wu Daguan, 2012.

[3] Zhao Yining, Great Country Project, 2018

[4] Liu Daxiang Jinjie Peng Youmei Hu Xiaoyu, Development Status and Key Technology Analysis of Large Aircraft Engines, 2008.

[5] Liu Daxiang, a historic opportunity for the development of aviation power, 2005.

[6] Han Xinwei, Chen Liangyou, Wu Hao, Countermeasures for Accelerating the Development of Aero-engines in China, 2003.

[7] Wen Junfeng, Brief Introduction and Thinking of Aeroengine Development, World Passenger Aircraft Research and Development, 1998.

[8] Han Rui, Lilac, Brief Introduction and Thinking on the Development of Aeroengines, 2012

[9] Pei Yu, further progress in the "domestic heart" of large aircraft, commissioning of CR929 engine verification machine, 2020

[10] Liu Zhenmin, China aero-engine industry development from the perspective of system innovation, 2019.

Original title: "At the moment of announcing the suspension of research and development, the audience cried" … Now China is no longer afraid of sniping! 》

Read the original text