The new invoicing tool "Tax UKEY" will meet you soon! Get to know this knowledge first.

1. How to adjust the invoice printing format by using tax Ukey?

Format adjustment of general VAT invoice: If it is the first time for installation and use, after issuing an invoice, click Issue and Print or click Invoiced to query and view the original invoice. On the original invoice page of VAT ordinary invoice, click "Print" and click

Icon, you can adjust the invoice printing format.

Adjustment of VAT roll invoice format: click the menu item System Settings/System Parameter Settings/Parameter Settings/Roll Invoice Configuration, and click Printer Settings to open the page margin setting window. Select a printer or adjust the page margins as needed, and then click OK.

The adjustment rules are that the ticket content needs to be moved to the left to reduce the left margin; Need to move to the right to increase the left margin; Need to move up to reduce the upper margin; Need to move down to increase the top margin. When adjusting the format of VAT ordinary invoice, if the face content needs to be adjusted to the left or right after adjustment according to this rule, but when the left margin is moved in the software, the content will not be printed completely, so it is necessary to move the position of the printer baffle. If the ticket content is printed to the left as a whole, how many printer baffles move to the left by the same distance.

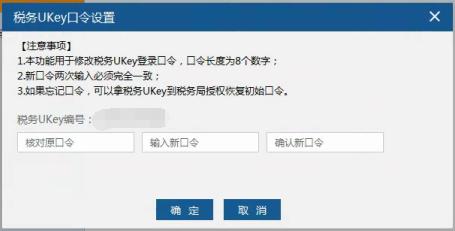

2. What is the password of tax Ukey?

The password of tax UKey involves three passwords: the initial password of "tax UKey" is 8 8; The initial password of "Digital Certificate" is 8 8, which must be modified for the first login; "Administrator login password", which is set by yourself during installation initialization.

3. Prompt when using tax Ukey invoice to fill out: Failed to query the code number of VAT electronic ordinary invoice. What should I do?

It is recommended to verify whether the invoice has been collected and purchased. If the invoice has been collected and purchased, follow the following steps: invoice management-invoice collection and purchase management-invoice online distribution, and then fill in the invoice after distribution.

4. What are the addresses and ports of the Ukey billing software server? What are the format file addresses and ports of the electronic invoice configuration?

Server address: fpkj.chongqing.chinatax.gov.cn, port: 555.

Format file server address: fpkj.chongqing.chinatax.gov.cn, port: 666.

5. When using tax Ukey to issue VAT electronic ordinary invoice, you are prompted with the message "Please complete the catalog setting first". How to operate it?

Click Invoice Management-Positive Invoice Filling-VAT Electronic Ordinary Invoice to open the VAT Electronic Ordinary Invoice window. When you enter for the first time, you need to click the "Directory Settings" button, and the "Import Settings" window will pop up, where you can set the import file directory, backup file directory, result file directory and scanning interval, and then click the "Save" button.

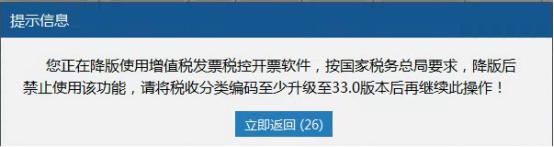

6. Using tax Ukey to issue invoices, the message "You are downgrading the VAT invoicing software. According to the requirements of State Taxation Administration of The People’s Republic of China, this function is prohibited after downgrading. Please upgrade the tax classification code to at least the latest version 33.0 before continuing this operation" is prompted. What should I do?

Upgrade the commodity and tax code to version 33.0.

Click System Settings-Basic Coding Settings-Goods and Services Tax Classification Code to enter the Goods and Services Tax Classification Code window, where you can download and import the code data.

Seven, the first login prompt, error code 09D106-did not find the specified data, how to do?

If only one tax Ukey is inserted, and only one tax Ukey is in use on the computer, that is, the tax Ukey has not been issued, it is recommended to issue it in the tax hall where the company is registered.

8. How does the tax Ukey version of VAT invoice software change the name of the drawer?

Log in to the billing software as an administrator, click System Maintenance-System Maintenance Home-Operator Management, and click Operation Identity Management to see if there is a "02 Billing Agent":

1. If there is a "02 drawer", click "Operator Account Management" and "Add Operator", enter the information of the drawer, select the drawer as "Identity" and click "Save".

2. If there is no "02 drawer", you need to increase the drawer’s authority first. The operation steps of adding a drawer are as follows: system maintenance-operator management-new identity-input identity-permission assignment (set the authority as needed). After adding, click "operator account management" "add operator", enter the drawer’s information, select the drawer by "identity" and click "Save".

When logging out of the software and logging in again, select the name to log in when logging in, and the drawer is the displayed name.

9. Can you set letters and special symbols in the tax Ukey password?

It can only be 8 digits.

10. What is the number limit for the certificate password? Can I set letters and numbers?

Certificate password digits, 6-8 digits, letters and numbers can be set.

XI. When adjusting the printer format for VAT ordinary invoices, it is suggested that "the error between the paper height and the actual invoice paper height is too large". What should I do?

The user has modified the paper height when adjusting the invoice format. The default paper height is 140, so just change the paper height back to 140.

12. Where can I download the public service platform?

Open a web browser, enter https://inv-veri.chinatax.gov.cn in the address bar to open the "State Taxation Administration of The People’s Republic of China National Invoice Inspection Platform", and click Related Downloads → VAT Invoice Invoicing Software (Tax Ukey Edition) to download the installation package.

13. When logging in with Ukey, the message "Abnormal server connection, do you want to update with offline files?" is prompted. How to operate?

1. The computer network must be normal. 2. The computer time and date are normal. 3. Click the menu item "System Settings/System Parameter Settings/Parameter Settings/Network Configuration" to pop up the server address and port configuration window, check whether the server address is "fpkj.chongqing.chinatax.gov.cn" and the server port is changed to 555, click "Test Connection", and click "OK" at the bottom after success.

14. I have logged in the Ukey version of the billing software on one computer, and now I have to install the billing software on another computer. Do you want to reset the Ukey password, certificate password and administrator password?

Ukey password and certificate password need not be reset. (If the Ukey password has not been modified, enter the initial password with 8 digits, and verify the digital certificate password with the modified certificate password) The administrator password can be reset.

15. What should I do if the invoice cannot be uploaded normally after using tax Ukey invoicing software?

When the network is normal, the system will automatically upload the invoice after it is issued; This problem is caused by abnormal network, so taxpayers are advised to reset the server port. The operation path is: system setting-parameter setting-network configuration-server port "555"; If the port is already "555", the taxpayer needs to log in again after logging out of the billing software, and test the connection when logging in. If the connection is still abnormal, it is necessary to check whether the server address is "fpkj.chongqing.chinatax.gov.cn". Please refer to the treatment method in Article 13.

Sixteen, how to use tax Ukey to copy tax returns?

Enter the billing system, click Data Management/Data Processing/Summary Upload, or in the process navigation window on the homepage of the software, click the icon button of Summary Upload to enter the summary upload window, where taxpayers can summarize and upload the summary invoices to be reported as needed, click the button of Submit Summary to report and summarize the invoice data, and click the button of Update Monitoring to update the invoice monitoring data information to tax Ukey. (After the "update monitoring" is successful, the billing deadline will be postponed to the next month; Pay attention to check the billing deadline after the successful operation of backwriting monitoring. If you want to make a declaration in the current month, do the declaration after the "report summary" is successful, and then do the "write back monitoring"; If you don’t declare in the current month, you can directly "update monitoring" after the success of "reporting summary")

XVII. How to set the tax rate displayed by using tax Ukey to show "tax exemption"?

The operation of adding codes to commodities shall refer to Article 18; When assigning codes, check whether to use preferential policies. Preferential policies are tax-free, tax rate is 0, and export tax-free and other tax-free preferential policies are selected.

18. How to deal with the case of the value-added tax roll invoice issued by tax Ukey?

The printed roll invoice is numbered and printed separately. The machine number is the invoice number issued from the software, and the printed number is the invoice that comes with the jump number on the paper invoice itself, to judge whether the paper invoice has been issued in the software but is used. 1. If the paper invoice is issued in the software but has not been used, make up the invoice already issued in the software; 2. If the invoice that has not been opened in the software has been used, the paper invoice will be invalidated in the software. 3. The software has been issued and paper invoices have been used, but the invoice number of the machine number is not matched, and the current month’s invoice is invalid, and the cross-month negative invoice is red-offset. Note: Voided invoices Paper invoices must be in your own hands before they can be voided in the software.

1. For example, the machine number is 00666706, the invoice number is 00666705, and the software has been opened to 00666706. The paper invoice has just been printed to 0066705, so that 00666706 will be typed up in the invoiced query, and 00666705 will be invalid (if this problem has been discovered for several months, 00666705 will be red-stamped).

2. For example, the phone number is 00666708 and the invoice number is 0066712. 00666708 has been issued in the software, and the next one will be issued 00666709, but the paper invoice has been issued to 0066712, and the next one will be issued to 0066713. It is necessary to find the paper invoice of 00666709-00666712, and then void the unopened invoice. 00666708 It is not clear whether the correct invoice number printed by the user is correct or not. If the paper invoice of 00666708 is not correct, the invoice issued in the current month will be invalid, and the cross-month invoice will be red-offset.

3. The phone number is 00666602, and the invoice number is 00666702. The paper invoice in the software is 00666602, and the paper invoice in 00666702 is put in it. It is necessary to put the paper invoice in 00666602 to make up the invoice already issued in the software, and then when the software is opened to 0066702, the unopened invoice will be invalidated.

Tips:

Source: Chongqing Taxation

Original title: "The new invoice issuing tool" Tax UKEY "will meet you soon! Understand this knowledge first. "