Shenzhen’s fiscal revenue fell by about 44%, and the contradiction between fiscal revenue and expenditure increased in April.

Recently, some provinces and cities began to announce the fiscal revenue and expenditure situation in April. Under the influence of unexpected factors such as the epidemic situation, the downward pressure on the economy has increased, and the contradiction between local fiscal revenue and expenditure has been increasing due to the reduction of income brought about by the large-scale tax rebate and tax reduction policy.

On May 11th, the Shenzhen Municipal Finance Bureau disclosed data showing that from January to April this year, the general public budget revenue in Shenzhen reached 130.98 billion yuan, down by 12.6%. In fact, in the first quarter, Shenzhen’s income still increased slightly, but in April, it fell by about 44%.

For the decline in fiscal revenue in the first four months, the Shenzhen Municipal Finance Bureau explained that the main reason was the policy reduction caused by the central government’s implementation of combined tax and fee support policies such as value-added tax refund and tax deferral for small and medium-sized enterprises in manufacturing.

This year’s 1.5 trillion yuan VAT tax refund policy was officially implemented on April 1. Due to the increasing difficulties of enterprises under the impact of the epidemic, the fiscal and taxation departments accelerated the tax refund progress. According to the data of the State Administration of Taxation, the value-added tax rebate in April was as high as 801.5 billion yuan. This is reflected in the local fiscal revenue, that is, the value-added tax revenue of the first major tax category has been greatly reduced. However, this move has increased the cash flow of enterprises and eased the financial pressure of enterprises. In the medium and long term, it is conducive to conserving tax sources and increasing fiscal revenue.

Affected by the new policy of tax refund, tax reduction and tax deferral, many places are similar to Shenzhen, and the fiscal revenue dropped significantly in the first four months, especially in April. This is confirmed in many cities and counties that took the lead in publicly disclosing the fiscal revenue and expenditure in April. For example, in the first four months, the general public budget revenue of Nanning, Guangxi decreased by about 6% year-on-year, Changzhou, Jiangsu decreased by 4.5% and Zhuzhou, Hunan decreased by about 4.9% year-on-year.

In addition, due to the spread of the epidemic in April, many residents were isolated at home, and some enterprises stopped production, which will also have an impact on local fiscal revenue.

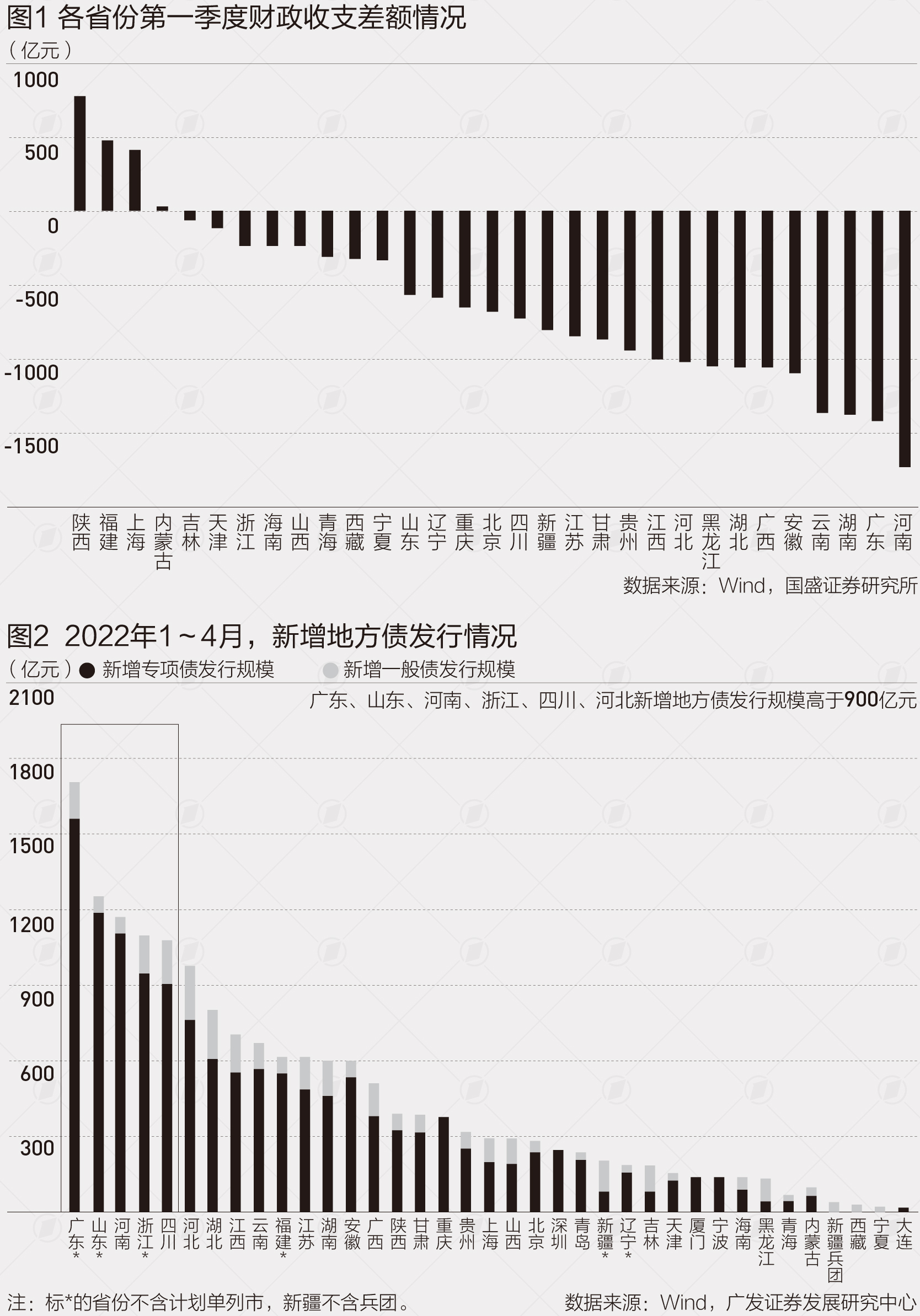

At present, there are fewer provinces that disclose the fiscal revenue and expenditure in the first four months. Judging from the fiscal revenue and expenditure data released in various places in the first quarter, there are great differences in the growth rate of local fiscal revenue, among which the fiscal revenue of resource-based provinces such as Inner Mongolia and Shanxi maintained rapid growth due to the rise in commodity prices or high operation.

Yang Yewei, chief fixed-income analyst of Guosheng Securities Research Institute, found that in the first quarter, in addition to economically strong provinces such as Shanghai and Fujian, resource-based provinces such as Shaanxi and Inner Mongolia also began to make the list. In the first quarter, Shanghai and Fujian were still in fiscal surplus, with a surplus scale of more than 40 billion yuan. However, resource-based provinces have also entered the ranks of fiscal surplus provinces due to the sharp increase in income, such as Shaanxi’s fiscal surplus of 80.2 billion yuan in the first quarter and Inner Mongolia’s surplus of 1.6 billion yuan.

However, with the obvious decline in local fiscal revenue in April, the contradiction between local fiscal revenue and expenditure has increased significantly. For example, the Finance Department of Hainan Province recently held an analysis meeting on the financial situation of the whole province. The meeting pointed out that since the beginning of this year, under the triple pressure of shrinking demand, supply shock and expected weakening, combined with the influence of the COVID-19 epidemic and the Ukrainian situation, the complexity, severity and uncertainty of China’s economic development environment have increased, and Hainan’s financial work is facing more severe difficulties and challenges, with the growth of fiscal revenue slowing down obviously, the progress of project capital expenditure being slow, and the task of completing the whole year is under greater pressure.

In order to alleviate local financial difficulties and support the implementation of policies such as tax rebate and tax reduction, at present, 800 billion yuan of transfer payment funds from the central government to support the grassroots to implement tax reduction and fee reduction and key people’s livelihood have all been distributed to local governments in April.

Wang Jianfan, director of the Budget Department of the Ministry of Finance, recently publicly stated that the Ministry of Finance urged and guided provincial financial departments to formulate targeted financial support programs for counties and districts with large tax rebates and relatively difficult finances, especially key counties and districts with tax rebates exceeding their own financial level. Close attention should be paid to them and one-on-one counseling should be carried out to ensure that these counties and districts can achieve stable financial operation while ensuring tax rebate funds, and the "three guarantees" can not be guaranteed.

In order to hedge the downward pressure on the economy, local governments, under the current situation of declining tax revenue, guarantee the construction of major projects by speeding up the issuance of local government bonds to ensure the steady investment and growth of bond funds.

According to the data of GF Securities Development Research Center, local debt increased by 1,681.3 billion yuan in April this year, exceeding the same period in 2019 and 2021, accounting for 38.7% of the annual new local government debt limit of 4,370 billion yuan. Among them, Guangdong’s new local debt issuance is the largest, reaching 172.7 billion yuan; Followed by Shandong, issuing 126.3 billion yuan; The scale of new local debt issuance in Henan, Zhejiang and Sichuan provinces is 100 billion to 120 billion yuan.

As the Ministry of Finance requires local governments to complete most of the new special bond issuance tasks before the end of June, the market expects a small climax of bond issuance in May and June.