[Exclusive report of the first project in machinery network]In October, in a short period of 8 or 9 days, a number of railway lines started construction. On October 18th, the Golmud-Dunhuang Railway with a total investment of 12.9 billion yuan was officially started in Golmud. On the same day, the Jingzhou-Yueyang section of the Mengxi-Huazhong coal transportation special line with a total investment of about 150 billion yuan also officially broke ground; On October 19th, as one of the "four verticals and four horizontals" high-speed rail networks in China, the Baolan Passenger Dedicated Line (Baoji to Lanzhou) was fully started. In the plan at the beginning of this year, the Ministry of Railways listed the Lanzhou Railway (Chengdu to Lanzhou) as the first item in the list of newly started projects in 2012. On October 27th, the Shaanxi section of Xi ‘an-Chengdu Passenger Dedicated Line officially started construction. On October 29th, Sichuan Branch of China Development Bank signed a loan contract of 10 billion yuan with Chenglan Railway Company to support the construction of Chenglan Railway. The number of new railway projects has increased by 13, from 9 at the beginning of the year to 22, and the railway infrastructure investment plan has been repeatedly increased from 406 billion yuan planned at the beginning of the year to 516 billion yuan, an increase of over 100 billion yuan.

Recently, the Ministry of Water Resources released a message that the state has arranged for the central government to invest nearly 40 billion yuan for the continued construction of 434 large-scale irrigation areas and water-saving renovation projects. In the future, the Ministry of Water Resources will accelerate the preliminary work of supporting the continuous construction of large irrigation areas and water-saving renovation projects. Based on this, the water conservancy construction industry is expected to usher in a new period of policy concentration by the end of the year, and it is expected that the water conservancy construction projects and equipment manufacturers involved in farmland will continue to obtain substantial benefits. At the same time, water conservancy construction has been accelerated at the end of the year as the east and middle lines of the South-to-North Water Transfer Project are about to be connected with water and funds. At present, some places have introduced financial support policies to promote the implementation of water conservancy funds, and the funds for key projects may be gradually relaxed. Some researchers predict that the total investment in water conservancy fixed assets this year is about 400 billion yuan, which means that there are still 140 billion yuan to be completed in the fourth quarter, with an average of 47 billion yuan per month. Under the promotion of policies, key projects delayed due to funding problems in the early stage were gradually started.

ropeQuotation:【Policy scanning】【Industry situation】【Enterprise aspect】【Product focus】【Engineering construction】【Post-market management】

I. Policy scanning:

According to customs statistics, from January to October, China’s total import and export value was $3,161.57 billion, an increase of 6.3% over the same period last year. Among them, exports were 1,670.9 billion US dollars, up by 7.8%; Imports reached US$ 1,490.67 billion, up by 4.6%; The trade surplus was $180.23 billion.

According to customs statistics, China’s total import and export value in October was $319.15 billion, an increase of 7.3%. Among them, the export was 175.57 billion US dollars, an increase of 11.6%; Imports reached US$ 143.58 billion, up by 2.4%. In October, the year-on-year growth rate of China’s total foreign trade import and export value rebounded by 1 percentage point compared with that in September, of which exports rebounded by 1.7 percentage points, and the growth rate of imports was the same as that in September. The trade surplus for the month was $31.99 billion.

From January to October, China’s exports of mechanical and electrical products reached US$ 957.38 billion, up by 8.5%, 0.7 percentage points higher than the overall growth rate of China’s foreign trade exports in the same period, accounting for 57.2% of China’s total foreign trade exports. Among them, the export of electrical and electronic products was 389.41 billion US dollars, an increase of 7.9%; Mechanical equipment was 306.77 billion US dollars, an increase of 5.9%.

Keywords: infrastructure investment public transportation Railway infrastructure construction Nuclear Power Project West-to-East Gas Transmission

Ministry of Finance: The central infrastructure investment in the first nine months of 2012 was 390.5 billion yuan.

By the end of September, the central infrastructure investment had allocated a budget of 390.5 billion yuan, accounting for 97% of the annual budget target, which was 8 percentage points higher than that of the same period of last year. The construction funds for key projects under construction, continued construction and newly started major national projects were well guaranteed.

This year, especially since May, in the face of the downward pressure on the economy, China has adopted a series of policies and measures to stabilize growth in time. After entering the third quarter, the economic growth rate has basically stabilized and presented a series of positive signals. [Details > >]

The State Council has identified eight key tasks to give priority to the development of public transport.

Wen Jiabao, Premier of the State Council, presided over the the State Council executive meeting on the 10th, and decided to expand the tuition-free scope of secondary vocational education, improve the national bursary system, give priority to the development of public transport in cities, and deliberated and passed the Regulations on the Management of Defective Automobile Product Recall (Draft).

The meeting pointed out that in order to fundamentally alleviate the contradictions such as traffic congestion, inconvenient travel and environmental pollution, it is necessary to establish the concept of giving priority to the development of public transportation and put public transportation in the primary position of urban transportation development. According to the principles of convenience for the masses, comprehensive connection, green development and local conditions, we should speed up the construction of an urban motorized travel system, which is mainly based on public transportation and consists of rail transit networks, buses and trams, and improve the conditions for walking and cycling. [Details > >]

China’s railway infrastructure investment may reach 2.3 trillion in the 12th Five-Year Plan.

The "Twelfth Five-Year Plan" railway infrastructure investment data that has received much attention has finally settled. During the Twelfth Five-Year Plan period, China arranged a total investment of 2.3 trillion yuan in railway infrastructure. However, where does the money come from? Experts said that the current financing method of railway construction projects still depends on bank loans and bond issuance, because the debt ratio of the Ministry of Railways and related enterprises in the railway infrastructure sector is too high, and banks are not enthusiastic about lending to railway construction projects. We should speed up the reform of railway investment and financing system, expand the proportion of direct financing, give full play to the enthusiasm of the central, local and enterprises, attract social capital to participate in investment, and promote the share reform and listing of railway enterprises. [Details > >]

Harbin-Dalian high-speed railway has been put into trial operation as the world’s first high-speed railway in alpine region.

On October 8, after overcoming many difficulties such as frozen soil construction, and after more than four months of debugging, the Harbin-Dalian high-speed railway began trial operation on the 921-kilometer-long line today and will be officially opened at the end of this year. This is the world’s first high-speed railway with a design speed of 350km/h, which can adapt to the lowest temperature of -40℃, and it will take more than three hours to travel from Dalian to Harbin, alleviating the pressure of Spring Festival travel rush in the three northeastern provinces. It is understood that the Harbin-Dalian Passenger Dedicated Line (high-speed rail) is the "one vertical" of the "four vertical and four horizontal" high-speed railway network in China’s medium and long-term railway planning, and it is an important part of the Beijing-Harbin high-speed railway. [Details > >]

Nuclear power projects are expected to resume the approval of trillion-dollar investment feast or restart.

The Twelfth Five-Year Plan for Nuclear Safety and Radioactive Pollution Prevention and Control and the Long-term Target in 2020 was recently approved by the State Council. According to the Plan, the investment demand for key nuclear safety and pollution prevention projects during the Twelfth Five-Year Plan period is about 79.8 billion yuan. People in the industry believe that the release of the Plan is the dawn of the restart of China’s nuclear power projects. According to experts’ analysis, at the moment when the international energy situation is tense and the cost of renewable energy is high, the development of nuclear energy is still the focus of the energy situation. According to the securities data, if the installed capacity of nuclear power is increased by 60 million kilowatts in 2020, the direct investment will reach 1.2 trillion yuan. [Details > >]

The first introduction of private capital into the third line of west-to-east gas pipeline has become the biggest highlight

On October 16th, the third natural gas pipeline project of PetroChina’s West-East Gas Pipeline started in Beijing, and the western section (Horgos, Xinjiang-Zhongwei, Ningxia) and the eastern section (Ji ‘an, Jiangxi-Fuzhou, Fujian) also started at the same time. The total length of the trunk branch line is 7378 kilometers, the designed annual gas transmission capacity is 30 billion cubic meters, and the total investment of the project is expected to exceed 120 billion yuan. It is planned to start construction after being approved by the state in 2013 and be completed and put into operation in 2015. It is worth noting that PetroChina introduced social capital and private capital to participate in the construction of the third line of west-to-east gas transmission for the first time, breaking the long-term monopoly of PetroChina and Sinopec. [Details > >]

Keywords: private enterprises importing and exporting overseas projects

The central government allocated 2.5 billion yuan of import discount interest funds in 2012.

The reporter learned from the Ministry of Finance on the 10th that in order to encourage the import of advanced technology and equipment, important raw materials, key parts and components, and promote the balanced development of trade, the central finance recently allocated 2.5 billion yuan of import discount funds in 2012, up by 25% over the previous year.

According to the person in charge of the Enterprise Department of the Ministry of Finance, since the establishment of the import discount interest fund in 2008, the central government has allocated 9.5 billion yuan for this fund, driving the import of products encouraged by the state to reach 111.352 billion US dollars, and the average import of 1 yuan RMB is nearly 12 US dollars. [Details > >]

Development and Reform Commission disclosed 20 approved overseas projects in half a month, and 6 private enterprises were approved.

The National Development and Reform Commission (NDRC) disclosed that four overseas investment projects had been approved. In the first half of October, the NDRC disclosed that 24 projects had been approved, including 20 overseas investment projects, 3 airport projects and 1 industrial project, which set a peak in the review and disclosure of overseas projects during the year. Nearly one third of the 20 overseas investment projects are invested by private enterprises.

Export alarm sounded construction machinery sales in Latin America or suffered heavy losses.

According to People’s Daily, Brazil has decided to increase the import tariff on some construction machinery products from 14% to 25%, so as to encourage the production of similar products in China and cope with the foreign trade competition brought about by the international crisis. At this point, the alarm that China’s construction machinery products are exported to Brazil has been fully sounded. In the past five years, China’s construction machinery exports to Latin America have reached 5.17 billion US dollars, with an average annual growth rate of 81.5%. By 2011, Latin American exports have accounted for 12.4% of China’s total construction machinery exports. China Construction Machinery Industry Association has urgently reported to the relevant ministries and commissions and suggested that tough measures be taken urgently. . [Details > >]

In the first three quarters of 2012, China’s total import and export value increased by 6.2% year on year.

According to customs statistics, in the first three quarters of this year, China’s total import and export value was US$ 2,842.47 billion, an increase of 6.2% over the same period last year. Among them, the export was 1,495.39 billion US dollars, an increase of 7.4%; Imports reached US$ 1,347.08 billion, up by 4.8%; The trade surplus was $148.31 billion. From the perspective of export commodities, the export of mechanical and electrical products grew steadily, while the export of textiles and clothing increased slightly. From the perspective of imported goods, the import of energy and resource products has grown steadily, and the import prices of iron ore, copper and aluminum have dropped significantly. [Details > >]

Keywords: China’s economic growth rate monetary policy Steady growth

The World Bank predicts that the growth rate of China this year and next will be 7.7% and 8.1%.

According to the report of Economic Data Monitoring of East Asia and the Pacific released by the World Bank on October 8th, the forecast of China’s economic growth rate this year and next has been greatly lowered from the previous values of 8.2% and 8.6% to 7.7% and 8.1%. Among them, the decline in investment demand in China led to a significant decline in investment growth, especially in non-governmental sectors. In the report "China in 2030" published by the World Bank and the Development Research Center of the State Council, China, it was predicted that the adjustment of economic structure and the gradual slowdown of economic growth would occur in the next 20 years, that is, the endogenous economic growth model would be realized. However, from now on, it is still difficult to determine whether this trend has been formed. [Details > >]

SASAC issued an early warning that the economy will enter a cold winter of three to five years.

In 2012, the global economic shock intensified, which triggered the return of the global real economy. The statistics of China’s real economy are worrying: in August, the growth rate of investment in fixed assets was at a historical low level, and the sales of construction machinery and other industries declined … The state-owned assets supervision and administration commission issued an early warning to all central enterprises, and China’s economy began to enter a period of austerity, so it is necessary to prepare for a cold winter of 3-5 years. Experts believe that cultivating the core competitiveness of state-owned enterprises can fundamentally enhance the national competitive strength and become a new responsible subject. Wu Jinglian, an economist, believes that the root of these problems still lies in the inadequacy of the current economic system. [Details > >]

It may be difficult to continue to relax monetary policy when the economy stabilizes.

According to the macroeconomic data released on the 18th, although the GDP growth rate dropped to 7.4% in the third quarter, the chain-on-chain growth rate continued to rise, and major economic indicators such as industrial production, export, investment and consumption picked up in September, indicating that China’s economy bottomed out and stabilized, and the economy is expected to rebound moderately in the fourth quarter, achieving the annual growth target of 7.5%. It is expected that the investment growth rate will continue to accelerate in the fourth quarter, and consumption will also rise steadily. Analysts believe that the signal that economic growth has bottomed out and stabilized is gradually clear, which reduces the necessity of introducing a large-scale relaxation policy in the short term, and the possibility of further RRR cuts and interest rate cuts during the year is low. [Details > >]

Steady growth policy moderately "opens the floodgates" for construction machinery or welcomes opportunities.

After a long period of economic recession, the expectations of various industries for the national investment-driven policy can be described as eager to see. Since September, the National Development and Reform Commission has "opened the floodgates" for infrastructure investment projects, and road traffic and warehousing construction projects, oil pipeline projects and major energy infrastructure projects have been launched one after another. Many people are worried that although the enthusiasm of local governments is high at present, it will be difficult to implement investment funds without bank loans and relaxation. However, the continuous downward trend of the economy is gradually affecting the thinking of decision makers, and it will only take time to relax the monetary policy, which will be good news for the construction machinery industry after 18 months of deep adjustment. [Details > >]

This article is the exclusive report of machinery network, the first project. If reproduced, please indicate the source, and offenders will be prosecuted!

Second, the industry situation

From October 25th to 27th, the 10th China Construction Machinery Marketing Summit Forum and the 2012 China Construction Machinery Agents Annual Meeting will be grandly opened in Kaifeng, Henan. This session focuses on the new pattern of China construction machinery industry, interprets the expectation of the new pattern for a new round of industry marketing reform, and discusses the growth space and possibility based on this. The 10th China Construction Machinery Marketing Summit Forum launched a summit dialogue between manufacturers and agents, which involved several major topics that affected the development trend of China construction machinery industry, such as "strategic transformation and thinking of enterprises, upgrading of innovative industries, global competition, survival rules of agents, and post-market value chain". In 2012, the annual meeting of construction machinery agents in China released "2012 China Construction Machinery Circulation Market Report" and "China Construction Machinery Industry Confidence Index", at the same time, awards were given to the top 50 enterprises that won the top ten marketing events and services of construction machinery in 2012. The results of "Top 10 Marketing Events and Top 50 Services of China Construction Machinery in 2012" were officially announced, and an on-site award ceremony was held.

Keywords: annual meeting of agents, annual meeting of top 50 service companies

The 10th China Construction Machinery Marketing Summit Forum and 2012 China Construction Machinery Agents Annual Meeting opened.

From October 25th to 27th, the 10th China Construction Machinery Marketing Summit Forum and the 2012 China Construction Machinery Agents Annual Meeting will be grandly opened in Kaifeng, Henan. This session focuses on the new pattern of China construction machinery industry, interprets the expectation of the new pattern for a new round of industry marketing reform, and discusses the growth space and possibility based on this.

The 10th China Construction Machinery Marketing Summit Forum launched a summit dialogue between manufacturers and agents, which involved several major topics that affected the development trend of China construction machinery industry, such as "strategic transformation and thinking of enterprises, upgrading of innovative industries, global competition, survival rules of agents, and post-market value chain". In addition, the summit forum also innovatively planned and organized sub-theme meetings such as market hotspots, marketing specials, aftermarket specials and small and medium-sized agent development forums, and invited mainstream enterprises and experts to communicate and exchange, so as to make the participants benefit.

Summit Forum strives to provide a high-end interactive communication platform for industry professionals, and to convey opinions from all sides and opinions of industry leaders to the followers of China construction machinery market development. [Details > >]

The 10th China Construction Machinery Marketing Summit Forum and 2012 China Construction Machinery Agents Annual Meeting opened.

2012 China Top 50 Construction Machinery Service held an award ceremony.

Adhering to the tenet of "providing in-depth service for the industry" and taking "response and development in transition period" as the theme, the 10th China Construction Machinery Marketing Summit Forum and the 2012 China Construction Machinery Agency Annual Meeting ended successfully in Kaifeng, Henan on October 27th. In 2012, the annual meeting of construction machinery agents in China released "2012 China Construction Machinery Circulation Market Report" and "China Construction Machinery Industry Confidence Index", at the same time, awards were given to the top 50 enterprises that won the top ten marketing events and services of construction machinery in 2012. The results of "Top 10 Marketing Events and Top 50 Services of China Construction Machinery in 2012" were officially announced, and an on-site award ceremony was held. [Details > >]

|

|

|

|

|

one

|

Tongguan group he’ nan wotong construction equipment co., ltd |

Volvo |

|

2

|

Lixinghang Machinery (Zhengzhou) Co., Ltd. |

Caterpillar |

|

three

|

He’ nan luyou machinery co., ltd |

|

|

four

|

He’ nan zhengliu engineering machinery co., ltd |

Liugong |

|

five

|

He’ nan Zhongyuan engineering machinery co., ltd |

Xiagong |

|

six

|

Shandong yonghong engineering equipment co., ltd |

Doosan |

|

seven

|

Shandong junda engineering machinery co., ltd |

modern times |

|

eight

|

Ji’ nan pangolin engineering machinery co., ltd |

Yuchai heavy industry |

|

nine

|

Ji’ nan liugong Yong’ an machinery equipment co., ltd |

Liugong |

|

10

|

Yantai hongtong machinery co., ltd |

Trinity |

|

11

|

Beijing hengri engineering machinery co., ltd |

Komatsu |

|

twelve

|

Beijing Junma Machinery Co., Ltd. |

Hitachi Construction Machinery, Dana Parker |

|

13

|

Weisite (Beijing) Machinery Equipment Co., Ltd. |

Caterpillar |

|

14

|

Beijing Zhongpu Zhongqi Machinery Equipment Co., Ltd. |

Zhonglian |

|

15

|

Shijiazhuang Tianyuan technology group co., ltd |

Komatsu |

|

16

|

Yunnan Anrui Mechanical & Electrical Equipment Technology Development Co., Ltd. |

Keith, Dana Parker |

|

17

|

Kunming tianxiao engineering machinery co., ltd |

Longgong |

|

18

|

Guizhou sanlong electromechanical equipment co., ltd |

Yuchai |

|

19

|

Guizhou liugong machinery equipment co., ltd |

Liugong |

|

twenty

|

Qinghai guanghui engineering machinery co., ltd |

Shandong Lingong |

|

21

|

Qianlima Construction Machinery Group Co., Ltd. |

Doosan |

|

22

|

Wuhan zhongnan engineering machinery equipment co., ltd |

Volvo, Shantui |

|

23

|

Hu’ nan Huayu Liugong machinery sales service co., ltd |

Liugong |

|

24

|

Hu’ nan zhongwang engineering machinery equipment co., ltd |

Trinity |

|

25

|

Hu’ nan province Dashan machinery co., ltd |

Shandong Lingong |

|

26

|

Shanxi tongbao engineering machinery sales co., ltd |

modern times |

|

27

|

Shanxi weili engineering machinery sales co., ltd |

Hitachi jianji |

|

28

|

Inner Mongolia Zhongcheng Engineering Machinery (Group) Co., Ltd. |

Longgong |

|

29

|

Liaoning hengli engineering machinery co., ltd |

Hitachi jianji |

|

thirty

|

Liaoning yuhua mechanical & electrical equipment group co., ltd |

Xugong, xuangong |

|

31

|

Fujian xiaosong engineering machinery co., ltd |

Komatsu |

|

32

|

Sichuan great huaye engineering machinery co., ltd |

KOBELCO |

|

33

|

Sichuan xinwote engineering machinery co., ltd |

Doosan |

|

34

|

Sichuan Ji feng Lian ke engineering machinery co., ltd |

Zhonglian |

|

35

|

Chongqing Zhibang Engineering Machinery (Group) Co., Ltd. |

Xugong, Zoomlion |

|

36

|

Shenzhen meipeng machinery equipment co., ltd |

Hitachi Construction Machinery, Sumitomo |

|

37

|

Guangxi qianlitong machinery equipment co., ltd |

Liugong |

|

38

|

Guangxi shantui engineering machinery co., ltd |

Shantui |

|

39

|

Guangxi Yangming engineering machinery co., ltd |

Sumitomo |

|

40

|

Guangxi Jiali electromechanical co., ltd |

Yuchai, metalworking |

|

41

|

Nanjing Gangjia Engineering Machinery Group |

Mountain push, Komatsu |

|

forty-two

|

Jiangsu tianheng weiye engineering machinery co., ltd |

modern times |

|

43

|

Jiangsu lihao engineering machinery co., ltd |

Trinity |

|

forty-four

|

Zhejiang Liyang machinery co., ltd |

Volvo |

|

45

|

Hefei zhongjian engineering machinery co., ltd |

Hitachi jianji |

|

46

|

Anhui Taiyuan Construction Machinery Co., Ltd. |

Doosan |

|

47

|

Hefei xiangyuan engineering machinery co., ltd |

Trinity |

|

48

|

Anhui nanya engineering machinery co., ltd |

KOBELCO |

|

forty-nine

|

Anhui shantui engineering machinery co., ltd |

Shantui |

|

50

|

Nanchang bairui industry co., ltd |

Shandong Lingong

|

2012 Annual Meeting of China Excavation Machinery Industry was held.

On October 23rd, 2012, at 8 o’clock in the morning, the 2012 annual meeting of China excavation machinery industry was held in Changzhou with the theme of "rational development and sustainable growth". Zeng Guang ‘an, President of China Construction Machinery Excavation Machinery Branch, Li Hongbao, Secretary General of Excavation Machinery Branch, Xin Chenhua, Director of Machinery Division of Equipment Department of Ministry of Industry and Information Technology, Zhang Liqun, Director of the State Council Development Research Center, Zang Jianzhong, People’s Government of Wujin District, Changzhou, and other guests attended the meeting, and met with more than 300 representatives of excavator manufacturers and agents from all over the country to discuss the development status and expectations of China excavator industry. [Details > >]

With the theme of "rational development and sustainable growth", the 2012 annual meeting of China excavation machinery industry was held in Changzhou.

Keywords: loader excavator industry is picking up

Analysis on the competition pattern of domestic loader and excavator industry

In 2011, China’s construction machinery industry focused on the transformation of development mode, with adjustment, transformation, innovation and upgrading as the main line. The sales revenue of 20 categories of construction machinery products in China exceeded 500 billion yuan, up more than 17% year-on-year. At present, not only the production and sales amount of the whole industry ranks first in the world, but also it meets the market demand of nearly 90% in China. In December 2011, the total industrial output value of the national construction machinery industry was 51.371 billion yuan, a year-on-year increase of 24.02%; An increase of 0.34% from the previous month; The sales output value reached 49.721 billion yuan, a year-on-year increase of 23.87%; The chain increased by 1.07%. The production and sales rate in November was 96.08%, an increase of 0.98 percentage points over the previous month. In December, there was a certain gap in the growth rate of total industrial output value and industrial sales output value of the two sub-sectors under the construction machinery industry. [Details > >]

The downstream industry continues to pick up, and the construction machinery industry is expected to benefit.

On September 24th, China Machinery Industry Federation announced the operation express of the national machinery industry in August, which showed that from January to August 2012, the economic operation speed of the national machinery industry showed a downward trend. In August, the cumulative year-on-year growth rate of total industrial output value was 11.95%; The cumulative year-on-year growth rate of industrial sales output value was 11.64%, and that of export delivery value was 5.32%. The year-on-year and month-on-month decline in the construction machinery industry did not last in August, and the market showed signs of recovery. With the acceleration of infrastructure construction and the rebound of real estate sales, the benefit stage of construction machinery is coming again. [Details > >]

Keywords: agent system, industry, baotuan club

Construction machinery agents face the pressure of reshuffling.

In 2012, the construction machinery industry is facing the biggest difficulty in a decade. When the current construction machinery industry is in a downturn, what is the situation of construction machinery agents, the main force in the front line of sales? Statistics show that in the first half of the year, the total accounts receivable of eight major construction machinery stocks reached 70.3 billion yuan, an increase of 55% compared with the same period last year. China Construction Machinery Industry Association recently organized spare parts suppliers, OEMs, agents and end users to gather together to discuss how to understand each other to tide over this round of difficulties. The whole construction machinery industry is United and ready to overcome the difficulties together. [Details > >]

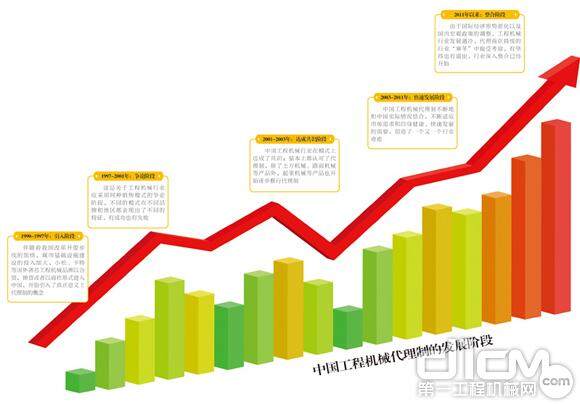

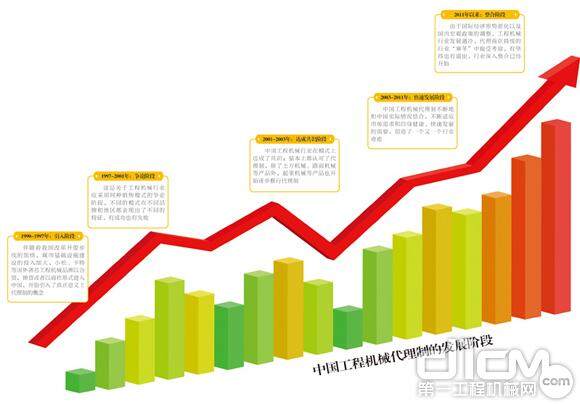

Chinese evolution of agency system

Recently, the dissolution of agency cooperation between Sany Heavy Machinery Co., Ltd. and Beijing Founders has been widely circulated in the industry. In this regard, neither party disclosed the details of the breakup nor made a formal response. However, according to the reporter’s understanding, the focus of the problem mainly lies in the differences between the two sides in terms of agency brand, agency area and development direction and strategy of agency enterprises. At present, the two sides are actively negotiating to find a solution, and the follow-up issues are still unresolved, but the breakup is a foregone conclusion. As a well-known enterprise among China construction machinery manufacturers and agents, no matter how to deal with the aftermath in the end, the interests of both parties will be damaged. In fact, similar incidents have occurred in recent years. At present, all kinds of problems about the construction machinery market and agency system in China, which are concealed under the rapid development of the market, seem to have surfaced. In China, the agency system has grown from rare to prosperous, which has not only achieved the huge scale of the construction machinery market in China, but also achieved a number of excellent agents. However, when the market encounters a cold winter, when the scenery of the industry’s extraordinary development is gone, and standing at the crossroads where barbaric growth and profit model transformation have to be ended, some agents feel confused. What’s the problem? Where is the direction? [Details > >]

Development stage of construction machinery agency system in China

How to get out of the dilemma for construction machinery market risk expansion agents

At the end of 2008, in order to protect China’s economy from the impact of the western economic crisis, the China government issued a 4 trillion rescue plan, and many major engineering projects under the government’s intervention were launched one after another, which brought huge "cakes" to the construction machinery industry. Many enterprises began to compete for quantity and expand sales by means of credit. These two double actions were like a huge sponge, which seriously overdrawn the market demand. When everyone’s 4 trillion cakes were eaten, the bitter fruit of the overdraft market began to stand out. How to treat the current market and future direction? Listen to Mr. Xie Bangrong, the chairman of Nanjing Gangjia Construction Machinery Group, a benchmark enterprise among construction machinery agents, trying to solve the industry puzzle. [Details > >]

Thirty agents of Sany Heavy Industry set up operators’ clubs.

In 2012, Sany Heavy Industry set off a wave of construction of operators’ clubs nationwide. The club takes "concrete heart working together to pump into the future" as the theme slogan and helps customers succeed as the organizational purpose. Up to now, 30 agents of Sany Heavy Industry have successively completed the preparatory work for operators’ clubs, and initially established a club network covering 300 Yu Sheng and more than 100,000 operators in the industry. Through a series of special trainings and activities, such as operator’s night, operator’s contest, and "excellent pumping" operator training camp, customers can further appreciate Sany style, understand equipment knowledge and improve operation skills. [Details > >]

Keywords: concrete machinery Excavator manufacturer Changzhou

It is difficult to restrain the expansion impulse of concrete machinery industry, and overcapacity will leave sequelae

Since the growth rate began to decline rapidly in the second quarter of 2011, the construction machinery industry has not yet shown signs of going down, and the growth of the whole industry is still "bottoming out". Affected by this, the previously expanded production capacity of construction machinery enterprises is becoming excess capacity. While Shantui, Liugong and Xugong continue to strengthen the competitiveness of the concrete machinery business sector, the overcapacity of concrete machinery continues to lead to industrial competition and upgrading. According to industry insiders, the overcapacity of domestic construction machinery industry is the surplus of low-end products, and there is still room for development in the field of high-end products. Only by increasing innovation can there be room for survival. [Details > >]

It is very important for excavator manufacturers to deal with the pressure increase.

The 16-month downturn has made the excavator industry feel great pressure. In the first half of 2012, accounts receivable of industrial enterprises increased by nearly 3/4 year-on-year; The inventory amount exceeds 10 billion yuan, up 30% year-on-year, and the cash flow from operating activities is negative, and problems such as creditor’s rights, inventory, funds, agents, factories, suppliers and talents are gradually emerging. However, according to GPS data, the working hours of excavators began to increase in September, which means that the pressure of payment and sales will gradually ease in the future. People in the industry should analyze and judge the national economic and policy direction, choose the right decision, and make every effort to tide over the most difficult period. [Details > >]

The intelligent development of Changzhou construction machinery industry should be grasped from early.

The construction machinery industry has now become an important part of the industrial economy in Changzhou High-tech Zone. At present, the total production and sales of the construction machinery industry in the region accounts for 11.8% of the industrial proportion of enterprises above designated size in the region; And the proportion of the city’s construction machinery industry is 50.9%! On September 20th, the "2012 Changzhou Construction Machinery Development Roundtable" hosted by Changzhou National High-tech Zone Management Committee discussed the above major issues. Leaders of China Construction Machinery Industry Association and representatives of local enterprises such as Chang Lin, Hyundai Jiangsu, Komatsu Changzhou and Terex attended the meeting and made suggestions for the development of Changzhou construction machinery industry. [Details > >]

Keywords: Xiang Wenbo market go tostock enterpriseaccount receivable Transformation and upgrading

Sany Xiang Wenbo: The construction machinery market will hardly improve in 2012.

Xiang Wenbo, president of Sany Heavy Industry, recently said in Weibo that the market of construction machinery industry will hardly pick up in 2012. He pointed out that some varieties with excessive market overdraft still have great downward pressure, and products with relatively rational competition, such as road machinery and excavation machinery, may take the lead in recovery. As a whole, next year may still focus on adjustment and digestion, hoping that the industry will resume normal growth in the second half of next year or at the end of next year. But he is still full of confidence in the development of the industry. "China’s economy will enter a new golden period of development from next year, and with the strong export of construction machinery industry, China’s construction machinery industry is likely to enter a new round of rapid growth." [Details > >]

The 8th Construction Machinery Technical Quality Exchange Meeting held innovation and upgrading.

On October 15th-18th, the biennial "National Technical Quality Information Exchange Meeting of Construction Machinery and Vehicles and the General Meeting of Quality Working Committee of China Construction Machinery Industry Association" was held in Changsha. Focusing on the theme of "technological innovation and upgrading, going to the international market", the meeting analyzed the industry prospect and the improvement of enterprise innovation ability. In the face of difficulties, how can enterprises seek comprehensive promotion and development in the competition and realize the transformation from quantitative scale to quality and efficiency? The analysis pointed out that we should closely follow the national industrial policy situation, establish a technology research and development system combining Industry-University-Research, promote the autonomy of major technical equipment, and enhance international competitiveness. [Details > >]

The survival rule of construction machinery under meager profit: destocking and transformation

At present, the whole construction machinery industry has begun to undergo a thorough transformation and reconstruction, and meager profit management has become an inevitable and necessary "pain" in the process of industrial upgrading of construction machinery industry. Whether an enterprise can accelerate the pace of transformation and upgrading in the fields of technological innovation, service innovation, business model innovation and development strategy innovation has become a crucial factor for it to successfully cope with the external situation and pass the survival test during the meager profit operation period. Experts said that the situation of overcapacity must be changed, and it is necessary to improve the competitiveness of products, avoid price wars, speed up the transformation of industrial enterprises, and break high-end technical barriers. [Details > >]

In the future, the development space of small construction machinery industry is broad.

With the continuous improvement of domestic infrastructure, China’s construction mode has gradually begun to change, and the prospects for small construction machinery and equipment are bright. Coupled with the gradual deepening of China’s new rural construction, small equipment is more and more widely used in rural and small town construction. At the same time, with the rapid development of environmental protection and ecological construction, the construction of gardens, greening and farmland is increasing, and the development prospect of small construction machinery is very broad. [Details > >]

Beware of triangular debts in machinery industry when receivables increase to a critical level.

Accounts receivable are an important part of current assets of enterprises, and high accounts receivable is a prerequisite for the formation of triangular debts. Recently, Zhao Xinmin, director of the Statistics and Information Work Department of China Machinery Industry Federation, said that the accounts receivable of heavy machinery and construction machinery industry are growing rapidly and need special attention. Up to now, the increase of accounts receivable in machinery industry is still in the range of 16%~18%, and the total amount is increasing year by year. Insiders suggest that the national level should organize and coordinate the clean-up and formulate relevant specific measures to untie the chain of debt-creditor relationship. [Details > >]

Su Bo: Developing High-end Equipment Manufacturing Industry and Promoting Industrial Transformation and Upgrading

On October 12th, the Shanghai Municipal Government held the Shanghai High-end Equipment Manufacturing Promotion Conference. Su Bo, Vice Minister of the Ministry of Industry and Information Technology, attended the meeting and gave a speech entitled "Vigorously develop high-end equipment manufacturing industry and promote industrial transformation and upgrading", and unveiled the Shanghai High-end Equipment Manufacturing Industry Alliance, Shanghai Robot Industry Alliance and Shanghai High-end Equipment Finance and Insurance Service Alliance. In recent years, the Ministry of Industry and Information Technology has taken important measures to promote the development of high-end equipment manufacturing industry, such as increasing support for independent innovation research and development, expanding the scope of preferential policies for major technical equipment imports, and strengthening technological transformation of enterprises. [Details > >]

This article is the exclusive report of machinery network, the first project. If reproduced, please indicate the source, and offenders will be prosecuted!

Third, the point of view of enterprises

Keywords: Sany Group sued Obama and Zhao Xiangzhang

Sany Group sued the Obama administration for strictly safeguarding the rights and interests of investment in the United States.

On October 18th, Sany Group held a press conference in Beijing to respond to Sany Group’s lawsuit against US President Barack Obama and CFIUS, the investment committee in the United States. In July, the wind farm project operated by Ralls, an affiliated company of Sany Group, in the United States was banned on the grounds of "threatening US national security", and then Obama issued an administrative order prohibiting the project; In October, Ralls added Obama as the defendant, accusing him of violating the provisions of the US Constitution to protect property rights. This is the first time that China enterprises have sued the President of the United States and CFIUS, which is a precedent for China enterprises to protect their rights according to law when they invest in the United States and encounter matter of justice. At the same time, the Ministry of Commerce recently expressed the hope that the judicial department of the United States will hear the lawsuit fairly, fairly and openly. [Details > >]

Mr. Wu Jialiang, Deputy General Manager of Sany Group and CEO of Ralls Company of the United States, stated

Mr. Zhao Xiangzhang, Senior Vice President of Sany Heavy Industry, submitted his resignation.

On October 11th, 2012, machinery network, the editor of the First Project, learned from the announcement of Sany Heavy Industry that Mr. Zhao Xiangzhang, the director and senior vice president of Sany Heavy Industry, submitted his resignation letter for work reasons, and applied to resign as the senior vice president of the company. After his resignation, he continued to serve as a director in the company. From 2000 to 2003, Zhao Xiangzhang successfully planned, organized and promoted the A-share listing of Sany Heavy Industry, which opened up the company’s continuous financing channels in the capital market and provided a good platform for Sany to achieve leap-forward development. In 2006 -2007, we successfully organized and promoted the private placement of Sany Heavy Industry, the long-term bonds of the National Development and Reform Commission and the short-term bonds of the People’s Bank of China, and raised more than 3 billion yuan for the company at one time. [Details > >]

Zhao Xiangzhang, CEO of Sany International, resigned.

Recently, Sany International announced that Zhou Wanchun had resigned as executive director, member of strategic investment committee and CEO. Mao Zhongwu has resigned as Chairman of the Board of Directors, Chairman of the Strategic Investment Committee and Chairman of the Nomination Committee, but continues to be an executive director, member of the Strategic Investment Committee and member of the Nomination Committee, effective from the 12th of this month.

On the same day, Zhao Xiangzhang, director of Sany Heavy Industry, was appointed as executive director, CEO and chairman of the board of directors, and was appointed as chairman of the strategic investment committee. [Details > >]

Keywords: Zoomlion Weinan Industrial Park Earthmoving Machinery

Member Chinese People’s Political Consultative Conference inspected Zhonglian Weinan Earthmoving Machinery Industrial Park.

Recently, Member Chinese People’s Political Consultative Conference and the Standing Committee of CPPCC visited Zoomlion Earth Machinery Industrial Park. It is reported that Weinan High-tech Zone has speeded up the adjustment of industrial structure, organically unified maintaining stable and rapid economic development with accelerating the transformation of economic development mode, and built a new industrial cluster park. Zoomlion Weinan earthmoving machinery industrial park project covers a total area of 2,000 mu, which is mainly divided into three phases, the first phase is mainly excavator production project, the second phase is mainly tower crane and elevator production project, and the third phase is bulldozer production project. At present, the first-phase excavator production project has been put into production, with an annual output of 10,000 excavators. [Details > >]

Fearless "cold winter" Zoomlion’s internationalization strategy has achieved initial results

Following the successful sales of a single 200 ZE360E excavators in Inner Mongolia, Zoomlion Earthworks Company sent the good news that 400 excavators were exported to the Middle East. On August 23rd, the first day after the holiday of Eid al-Fitr in the Arab world, Zoomlion Earthwork Company Middle East received a contract advance payment paid by a group customer as scheduled, which marked that a large order with a total number of more than 400 units and a value of 300 million yuan officially entered the implementation stage. The signing of this order set a new record for the largest single sales in the Middle East, and also marked the initial success of Zoomlion’s internationalization strategy with global layout. [Details > >]

400 excavators of Zoomlion Earthmoving Machinery Company were exported to the Middle East at the launching ceremony.

Zoomlion was once again supported by the Provincial Natural Science Fund.

Recently, the Natural Science Foundation of Hunan Science and Technology Department issued a notice, and the project "Research on Vibration Response and Active Control of Concrete Pump Boom under the Coupling Effect of Hydraulic Pressure and Concrete Impact" declared by Dr. Yi Huang from the Engineering Technology Center of Zoomlion Concrete Machinery Company was funded by the Natural Science Foundation of Hunan Province in 2012. This funding not only affirmed the strong strength of Zoomlion’s high-end R&D talents, but also fully reflected the recognition that Zoomlion attaches great importance to basic research work, and also achieved a breakthrough that Zoomlion Concrete Machinery Company hosted the Natural Science Fund project. [Details > >]

Keywords: Xugong Rare earth storage exit Qian’ an Brazil

Xugong invested 490 million yuan to enter Ganzhou Rare Earth Storage Company.

Xugong Machinery announced in the evening that the company plans to invest 490 million yuan in Xugong, a wholly-owned subsidiary. Xugong Investment plans to invest 490 million yuan to jointly establish Ganzhou Rare Earth Storage Co., Ltd. with Ganzhou State-owned Assets Company and Ganzhou Hongtai. The registered capital of the storage company is 1 billion yuan, and the contributions of Xugong Investment, Ganzhou State-owned Assets Company and Ganzhou Hongtai account for 49%, 46% and 5% of the shares of the storage company respectively. The purchasing and storage company is mainly engaged in the sales of rare earth separation products and rare earth metal products, the development of rare earth deep processing products, the sales of chemical raw materials and auxiliary materials for rare earth production, and the consulting of rare earth technical services.

According to the announcement, due to the scarcity and extensive application of rare earth resources and the unique position of China’s rare earth resources reserves and supply, investing in the establishment of a storage company will expand the company’s business scope and enhance the company’s visibility in the resource field, which is expected to achieve a rich return on investment. [Details > >]

People’s Daily published an article praising Xugong Group’s contrarian growth.

On October 14th, People’s Daily published an article entitled "How to treat some enterprises’ operational difficulties" in the column of "Face to Face with Economic Hotspots", praising Xugong Group for achieving contrarian growth under the current severe international economic environment. Taking Xugong Group as an example, this paper points out that Xuzhou has developed from low-end processing and assembly to high-end industrial value chain by persisting in technological transformation and innovation and mastering a series of core technologies, and its profitability has been enhanced. From January to July, Xugong Group exported more than 7,000 sets of various types of construction machinery, with a total of 900 million US dollars in export delivery value, up 49% year-on-year. [Details > >]

Xugong Northern Base Project with a total investment of 3 billion yuan settled in Qian ‘an.

On the morning of October 27th, Xugong Group’s mining machinery and equipment manufacturing base and supporting projects were officially signed in Qian ‘an, which is the only investment project of Xugong Group in North China at present, which is the leader of the national equipment manufacturing industry. Jong Li, Mayor of Qian ‘an City, signed a contract with the head of Xugong.

"The Qian ‘an project of Xugong Group mainly includes a large-scale mining machinery manufacturing base, a supporting parts production base, a mining machinery research branch, a construction machinery trade city and a talent apartment supporting the project. The total investment of the project is 3 billion yuan, which will be built in two phases. After the project is put into production, it will realize sales income of 5 billion yuan and profits and taxes of 750 million yuan." Yang Dongsheng, vice president of Xugong Group and general manager of science and technology branch, said at the signing ceremony: "As the largest investment project of Xugong Group in North China, after the project is completed and put into production, Qian ‘an will become an industrial base radiating the whole core area of North China and Northeast China and the largest mining machinery manufacturing base in China." [Details > >]

XXCMG XAP120 new asphalt mixing station came out successfully.

Recently, the XAP series asphalt mixing station of the mixing station factory has added a new member-XAP 120 mixing station. XAP120 is a new asphalt mixing station independently developed by Xugong Technology. This product has the technical advantages of small unit module, high reliability and intelligent control, and meets the development trend of modularization, high efficiency, energy saving and environmental protection of containers. This product is not only high in technical content, reasonable in design, but also convenient to operate, beautiful in form and small in floor space. Compared with similar products in China, it has a fairly strong competitive strength and a fairly broad market space. At present, XAP120 asphalt mixing station has completed the assembly of parts and entered the pre-assembly stage of the whole machine. This year, Xugong asphalt mixing station has been eye-catching against the trend, and has made great breakthroughs in sales volume and regional market. After XAP new asphalt mixing station is put into the market, it will further enrich the product spectrum of Xugong asphalt mixing station, enhance the competitiveness of the product series of mixing station and become a powerful economic growth point. [Details > >]

In the first nine months, Xugong products exported to Brazil exceeded 1,200 units, up 200% year-on-year.

With the deepening of Xugong’s internationalization journey, the Brazilian market is one of the important overseas export markets and manufacturing bases of Xugong Group. From January to September, 2012, the export performance was gratifying, reaching new heights repeatedly, with over 1,200 vehicles starting, up by 200% year-on-year, even spanning two steps, and the rising trend was gratifying. This year, Xugong Import & Export Company actively cooperated with the construction of Brazil Industrial Park, and gave full play to its subjective initiative. On the one hand, it maintained and supported the distributor’s sales outlets, and reserved equipment in advance according to the market forecast, especially cranes, loaders and excavators that are expected to be exported in batches. [Details > >]

Keywords: Volvo excavator Keith the Digger microfilm

2012 Volvo Digger Finals: The strongest voice in excavator industry.

2012 is a year in which Volvo’s "Digging for War Talent" competition achieved a breakthrough. This year’s competition is larger than the last one, with higher overall level of contestants and far-reaching industry influence. The contest fully demonstrated the good spirit of excavator operators in China and delivered a positive energy to the industry. This year’s competition set up a "popular star" session to set up a stage for excavator operators to perform their talents, and introduced 120 first aid and mechanical repair and maintenance courses in the training session. In 2012, Volvo’s "Digger" set an example for building comprehensive talents, saved energy for the industry to meet new development opportunities, and performed the strongest voice in the excavator industry. [Details > >]

2012 Volvo Digger Finals: The strongest voice in excavator industry.

Development of collision warning system with emergency braking function for Volvo trucks

Recently, Volvo trucks have developed a collision warning system with emergency braking function to avoid collision accidents caused by distraction. This new system uses radar and camera to identify and monitor the vehicles in front, which can avoid colliding with vehicles that are stationary or whose relative speed is within 70 kilometers per hour. When the system detects that the truck will hit the vehicle in front, it will automatically start the flashing red light mode at the windshield to remind the driver to concentrate on the road immediately. When all attempts to avoid collision fail, the emergency brake will be activated and the truck will be stopped completely by all means. [Details > >]

Case Construction Machinery Shoots the First Microfilm in the Industry

Construction machinery is a tradition among traditions because of its "heavy" characteristics. However, CASE Case Construction Machinery has recently made a bold attempt and made a micro-movie. "I believe that everyone can see the finished product soon. Microfilm can tell an impressive story in a short time. We want to change the form of traditional advertising films and spread them in the form of microfilm, which not only pleases customers, but also conveys the spirit of Case and promotes Case equipment. " Howard Dale, CEO of Case Construction Machinery Asia Pacific, said that the attempt of microfilm is also an innovative move of Case in image promotion. [Details > >]

Keywords: Liugong Antarctic scientific research mountain push SINOMACH MAG temporary work

Liugong machinery is ready to go to the South Pole with the "Snow Dragon"

On October 17th, Liugong held a ceremony in Liuzhou headquarters to go to the Antarctic expedition with the Snow Dragon. As technical experts, Liao Huanmin and Li Chuanhong were selected by polar research institute of china as the members of the 29th expedition to the Antarctic. This is the third batch of technical experts who participated in the national polar scientific research after Yan Wei and others. At the same time, Liugong engineering machinery and equipment will appear in extremely cold conditions for the first time. On the 23rd, Liugong will hold the "Donation Ceremony of China Antarctic Scientific Research Equipment" at the special pier of Xuelong in Pudong Port, Shanghai. The mechanical equipment donated by Liugong will go to the polar battlefield to contribute to the polar scientific research. [Details > >]

The research group of the State Administration of Work Safety investigated the safety training of Shantui.

On the afternoon of October 12th, Deputy Director Zhang Yong of state administration of work safety made an investigation on Shantui safety training. Deputy Director Zhang Yong pointed out: the State Council has made safety training, safety science and technology and safety law enforcement the three major priorities of China’s safety production supervision in the next 15 years, among which safety training is the first priority. Shantui always puts safety training in the top priority of all work, pays attention to the innovation of training forms and the diversity of training contents; Safety training has clear thinking, effective measures and obvious effects, which fully shows the quality that national first-class safety production standardization enterprises should have. [Details > >]

SINOMACH bids for German MAG Chinese enterprises to buy German companies six times a year.

On October 6th, according to Reuters’s report, China Machinery Industry Group has formally submitted a bid offer to German competitor MAG; A spokesman for MAG confirmed that the company is now negotiating with potential acquirers and it is expected that the negotiations will be completed in the fourth quarter. Under the European debt crisis, China companies planned to bargain-hunt German enterprises and set off a wave of mergers and acquisitions. Since the beginning of this year, there have been five M&A cases in China manufacturing companies. If SINOMACH succeeds in bidding for MAG, it will increase the number of M&A cases to six. Experts suggest that it is necessary to fully consider the cultural integration, brand maintenance and transnational management promotion after mergers and acquisitions. [Details > >]

Lingong International Service "Pioneer" Brand "Behind the Temple"

"Under the current situation that the domestic market is relatively weak due to the overall macroeconomic environment, major enterprises, including Shandong Lingong, regard opening up the international market as a strategic way to promote enterprise development." The relevant person in charge of Shandong Lingong Strategic Planning Department said that Lingong is committed to building the preferred brand of construction machinery for overseas users, and internationalization strategy is the main development strategy of the enterprise. Taking the BRICS countries (Brazil, Russia, South Africa) and the Middle East countries as the core markets, and focusing on channel, service and brand building, is the key for temporary workers to make a breakthrough in the international market. [Details > >]

This article is the exclusive report of machinery network, the first project. If reproduced, please indicate the source, and offenders will be prosecuted!

Fourth, product focus

Keywords: Shanghai BMW Exhibition Caterpillar Mountain Push

Shanghai BMW Exhibition: Ten Years’ Interpretation of the Legend of "China No.1 Trade Exhibition"

Bauma China International Construction Machinery, Building Materials Machinery, Construction Vehicles and Equipment Expo "(Shanghai BMW Exhibition) will be grandly opened in Shanghai New International Expo Center from November 27 to 30, 2012. By then, the 300,000-square-meter exhibition space will gather nearly 2,700 exhibitors from 40 countries and regions around the world, with an estimated audience of more than 170,000.

Bauma China, as the extension of the world’s largest construction machinery exhibition in China, has become a competitive stage for global construction machinery enterprises. On this stage, there are many excellent enterprises and excellent products, which represent the most advanced productive forces, carry the historical mission of industry development, enhance the level of industrial civilization, and even change the life of each of us … [Details > >]

Four new Cat? products will be unveiled at BMW Shanghai 2012.

At the upcoming 2012 Shanghai BMW Exhibition, Asia’s largest construction trade fair, Caterpillar? will present its four brand-new products, including two hydraulic excavators, a wheel loader and a mining truck, to thousands of visitors in its exhibition area (exhibition hall N1 of Shanghai New International Expo Center). These new products will help Caterpillar’s investment and development in China’s construction industry, and expand the business scope of products and parts in China.

"China is an important market for our business development, and we are providing users with more valuable new products and services through continuous investment. Shanghai BMW Exhibition gives us the opportunity to close the distance with users and show them Caterpillar’s high-quality products, world-class technology and excellent after-sales service. " Phillip Pollock, Asia Pacific Marketing Manager of Caterpillar Global Infrastructure Division, said. [Details > >]

Four new Cat? products will be unveiled at BMW Shanghai 2012.

The core innovative products of Shantui Machinery will be unveiled at the 2012 Shanghai BMW Exhibition.

The highly anticipated "2012 China International Construction Machinery, Building Materials Machinery, Construction Vehicles and Equipment Expo" (referred to as "Shanghai BMW Exhibition") will be held in Shanghai New International Expo Center from November 27 to 30, 2012, and famous brands from leading enterprises at home and abroad will gather for the exhibition. Shandong Shantui Machinery Co., Ltd. will launch many innovative products with core innovation technologies for the industry at this grand event, and stage a new product symphony of "Quality Shantui, Smart Machinery" at this exhibition.

Shantui SER30 rotary drilling rig

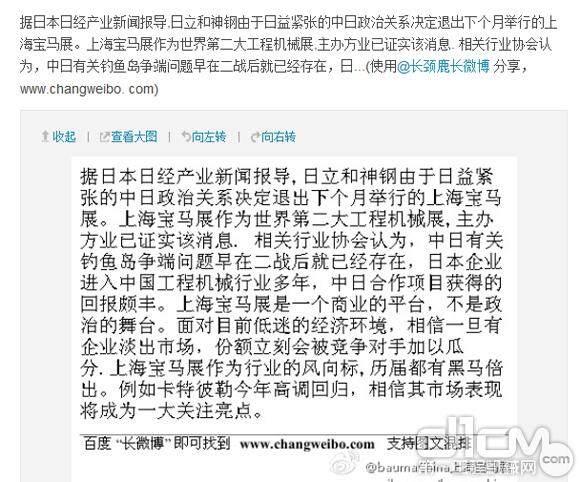

Three Japanese brands of construction machinery have successively withdrawn from Shanghai BMW Exhibition.

On November 27-30, baumaChina2012, the largest annual exhibition of construction machinery industry in 2012, will open in Shanghai. However, as the dispute over Diaoyu Islands between China and Japan continues to exist, Japanese brand construction machinery enterprises have gradually withdrawn from this BMW exhibition. Following KOMATSU’s initial confirmation that he would not participate in the exhibition, HITACHI Construction Machinery and KOBECLO of Kobelco Construction Machinery have formally submitted their applications to the organizing committee of baumaChina2012, announcing their withdrawal from this exhibition. At present, the news has been officially confirmed by the exhibition organizing Committee. It is reported that other Japanese brand enterprises have withdrawn from this BMW exhibition in the later period. [Details > >]

Information released by baumaChina Shanghai BMW Exhibition on its Sina Weibo.

Keywords: Zoomlion Tower Crane Guinness Record Excavator ZACB01

Zoomlion D1250-80 Tower Crane Set a Guinness World Record

"The D 1250-80 tower crane successfully lifted 5.5 tons of heavy objects in the working range of 110 meters, which is a new Guinness World Record." Through a series of key technical innovations, the machine has solved the problems of lightweight design of large working range boom and precise control of mechanism, and the performance of the whole machine ranks in the world’s leading level. In June, 2011, Zoomlion introduced the flat-headed tower crane technology of JOST Company in Germany, which not only deeply integrated in product research and development, process innovation and application of new materials, but also insisted on independent innovation, especially emphasizing the original innovation, integrated innovation and re-innovation on the basis of introduction, digestion and absorption. [Details > >]

Zoomlion launches the world’s largest ZACB01 wheeled crane.

Luo Kai, the engineer of Zoomlion, said: "Zoomlion ZACB01 is the largest wheeled crane in the world at present, and its successful off-line indicates that Zoomlion has become a new benchmark for the domestic super-large wheeled crane industry!" More than 80 proprietary technology patents have been applied for this product, and the invention patents exceed 50%. The maximum actual lifting capacity can exceed 1,000 tons, and the maximum lifting height can reach 160m m. ZACB01 is the only all terrain crane in the world that can hoist a 3MW wind turbine by using telescopic boom or special flying boom for wind power, and only using telescopic boom can hoist 800t chemical towers, tanks and metallurgical equipment. [Details > >]

Zoomlion’s largest order for concrete machinery in Iran market was successfully delivered.

On October 15th, Zoomlion Concrete Machinery Co., Ltd. and Iran A.K Company signed a single order for the largest amount of concrete machinery in the Iranian market, and the delivery was completed. This order is worth more than US$ 4 million, including 20 pump trucks and 9 towing pumps. A.K. Company is the most powerful construction machinery agent in Iran and the exclusive agent of Zoomlion earth-moving machinery in Iran. In the first half of the year, it successively purchased hundreds of sets of various construction machinery from Zoomlion. The signing of this order has broadened Zoomlion’s sales channels in Iran, and its market share in Iran is expected to increase by 30% in the next few years. [Details > >]

Keywords: Xugong excavator loader 37 million large orders

Nearly 100 excavators from Xugong were exported to Ghana, winning a large order of 100 million yuan.

Recently, the overseas market of Xugong Excavators has also reported good news: Xugong Excavators have won orders for Ghana with a total value of about 100 million yuan with excellent product quality, including nearly 100 products such as XE230C, XE260C, XE335C and XE370CA. This order has performed well in the global construction machinery market under the "cold winter" market situation, refreshing the sales record of Xugong excavators for single-batch export. Ghana is located in the west of Africa. Although its area is small, its abundant mineral resources are unusual, and its gold resources rank among the top 10 in the world. The expansion of gold mining capacity needs the introduction of a large number of advanced equipment. [Details > >]

Xugong concrete machinery Nanjing market signed 37 million big orders.

Recently, Xugong Construction Machinery Co., Ltd. signed 37 million large orders in Nanjing market, which is the first large order for Xugong concrete machinery products in Nanjing market, and blew the horn of Xugong concrete machinery to enter the main market of Jiangsu, the largest demand market for concrete machinery products in China. Since the beginning of this year, Xugong Construction Machinery Co., Ltd. has been keeping a close eye on the market demand and expanding the brand influence of Xugong concrete machinery products in accordance with the requirements put forward by Chairman Wang Min that "Xugong Group will form a three-point world structure in China and the world in the next three years". Xugong concrete machinery has been recognized and favored by the market for its excellent quality and excellent service. [Details > >]

60 LW300F loaders from Xugong were exported to Russia in batches.

Xugong’s export to Central Asia is another good news: exporting 60 LW300F loaders to Russia at one time. This export to Russia is also the largest single export volume of loaders in this region this year. The classic fixed axis design of LW300F loader has reliable performance. The transmission system and hydraulic system are perfectly matched, saving energy and protecting the environment. It is the first in China to start the automobile manufacturing process in an all-round way, using all-metal molded panels, electrophoretic painting, effective rust prevention, long-term maintenance of new car color, and high resale value. 12 tons of powerful bucket digging force ensures outstanding adaptation to various harsh working conditions. [Details > >]

Xugong independently researched and developed QAY1600 all terrain crane chassis off the assembly line.

A few days ago, the QAY1600 chassis of the world’s largest ground crane successfully rolled off the assembly line, marking that China has once again reached a new height in the R&D and manufacturing of super-tonnage all terrain crane chassis. QAY1600 all terrain crane chassis independently developed by Xugong Heavy Industry Co., Ltd. adopts self-made 9 axles, equipped with high-performance hydro-pneumatic suspension system, and adopts all-wheel multi-mode electro-hydraulic steering, which can realize various functions such as turning in place and crab steering, and the whole machine has stronger driving maneuverability. At the same time, QAY1600 chassis adopts multi-axle drive technology, which has strong power, can be used for heavy-duty driving and off-road, and the maximum climbing degree can reach 50 degrees. [Details > >]

Keywords: Caterpillar SKYFALL shovelexcavator 6030B FS

Caterpillar 6030B FS excavator will be launched in the fourth quarter of 2013.

The 6030B FS(316 tons) large-scale front shovel hydraulic excavator exhibited at MINEXPO 2012 is the first B series product in Caterpillar’s extensive hydraulic shovel product line. 6030B FS features a newly designed cab, which is ergonomically designed, with super visibility in the working area and a clear view of the arm and boom. These functions have improved the driver’s comfort and work efficiency. The inspection aisles and handrails have also been redesigned to enhance the safety of drivers and technicians. [Details > >]

Caterpillar 6030B FS hydraulic excavator.

Caterpillar Excavator Appears in 007 Bond Movie SKYFALL

James Bond and Caterpillar joined hands to participate in the 23rd Bond adventure film SKYFALL. The exciting part of the film shows Bond operating a Caterpillar excavator. Caterpillar prides itself on designing and manufacturing equipment to meet customers’ needs. According to the requirements of the production company, the 320DL cockpit was installed in reverse. At the shooting site, Caterpillar dealers provide on-site expertise and services, as well as shooting equipment, such as generator sets, a skid steer loader and mini hydraulic excavators. On October 23rd, "SKYFALL" premiered in London, and was released around the world after 26th. [Details > >]

Cat 316t front shovel excavator unveiled at 2012MINExpo.

At the recently concluded MineExpo 2012 in Las Vegas, Caterpillar showed the first B-series product in its hydraulic shovel product line, the ——6030B FS excavator. This machine is combined with a large number of Carter components that can improve its reliability and durability, and both front shovel and backhoe can be configured. Equipped with two C27 diesel engines, it can generate 1140kW of power, and it can provide a full set of diesel and electric-driven optional products. The B series products also adopt C95 GET and hydraulic hammer-free design, which makes the bucket teeth easy to assemble and disassemble. It adopts TriPower bucket kinematics principle, intuitive on-board electronic system and durable fuselage structure. [Details > >]

This article is the exclusive report of machinery network, the first project. If reproduced, please indicate the source, and offenders will be prosecuted!

V. Engineering construction

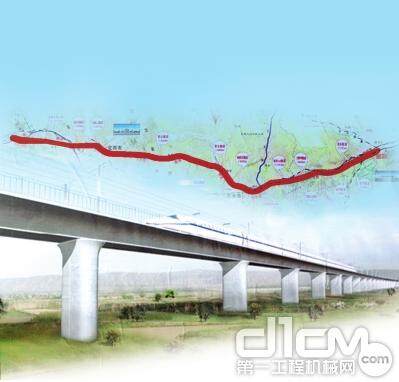

Construction of Baolan Passenger Dedicated Line started, and Gansu entered the era of high-speed rail.

Recently, the Shaanxi section of Baoji-Lanzhou high-speed rail project officially started. After the completion of this special line, passengers will take the high-speed rail from Baoji to Lanzhou, and the ride time will be shortened to 2 hours. Zhengzhou citizens only need about 5 hours to get to Lanzhou via Zhengxi and Xibao high-speed rail. It is reported that the Baolan Passenger Dedicated Line is designed as a high-speed railway, and the total construction period of the project is 5 years. This special line is the first high-grade railway passenger dedicated line built in the collapsible loess mountainous area in the west of China. After the completion of the project, Lanzhou to Baoji can be reached in 2.3 hours, and Lanzhou to Beijing can be reached in 8 hours, which greatly shortens the time and space distance between cities and realizes the networking between the northwest region and the national express passenger dedicated line. [Details > >]

Site map of Baolan Passenger Dedicated Line

Railway water conservancy intensive "catch up with work" construction machinery can take advantage of the situation to pursue

Near the end of the year, the promotion of railway engineering projects has once again become a hot topic, and railway construction has become a top priority for the Ministry of Railways.

A few days ago, some media reported that the Ministry of Railways will ensure that a number of new major railway projects will be started this year, and that a number of new major railway projects will be started this year, such as Zhengzhou to Xuzhou, Baoji to Lanzhou, Xi ‘an to Chengdu, Shijiazhuang to Jinan, Chongqing-Guizhou capacity expansion and Ningxi double track. Recently, 13 new railway construction projects have been added, from 9 planned at the beginning of the year to 22, and the railway infrastructure investment plan has been repeatedly increased from 406 billion yuan planned at the beginning of the year to 516 billion yuan, an increase of over 100 billion yuan … [Details > >]

Foundation laying ceremony of Baolan Passenger Dedicated Line

China’s construction of the third line of west-to-east gas pipeline network has recently started.

According to Xinhua News Agency, Beijing, October 24, another strategic energy transportation artery in China, the third-line project of West-to-East gas transmission, started recently.

Zhao Yujian, director of China Oil and Gas Pipeline Bureau, said that pipeline, as the fifth largest transportation form after railway, highway, water transport and air transport, is still a new industry in China. China’s oil and gas pipeline construction will last for 5 to 10 years to build a national oil and gas pipeline network. Following the first and second lines of west-east gas transmission, the third line of west-east gas transmission has started construction, and the fourth and fifth lines are under planning. In the construction of four strategic oil and gas import channels, the C line of natural gas pipeline in northwest and central Asia started in September this year, and the D line is expected to start next year. In Northeast China, the Sino-Russian natural gas pipeline is being planned, and the Sino-Russian crude oil pipeline will be expanded from 15 million tons to 30 million tons annually. In the southwest, the China-Myanmar natural gas pipeline is expected to be ventilated on May 1 next year. [Details > >]

The first trial run of Harbin-Dalian high-speed railway will accelerate the economic integration in Northeast China.